Prices

April 12, 2016

AIIS Report on February Steel Exports

Written by Sandy Williams

Exports of U.S. produced steel increased 7.8 percent from December to January and inched downward 0.4 percent in February. The latest American Institute for International Steel (AIIS) report on U.S. steel exports follows:

Falls Church, VA. April 12, 2016. Steel exports totaled 779,010 net tons in February, just 0.4 percent less than the previous month, but 11.3 percent below the level of a year earlier.

Exports to both Canada and Mexico, which account for about 90 percent of all steel shipments out of the United States, both changed by less than 1 percent from January, with exports to Canada up slightly at 392,571 net tons, and exports to Mexico down a bit at 295,530 net tons. Compared to February 2015, exports to Canada dipped 3.4 percent, while exports to Mexico fell 15.8 percent. Exports to the European Union were down 5.9 percent from the previous month and 63.3 percent from the previous February at 17,824 net tons.

During the first two months of the year, total exports fell 13.5 percent to 1.56 million net tons. Year-to-date exports to Canada were down 11.7 percent at 783.909 net tons, exports to Mexico fell 13.8 percent to 593,823 net tons, and exports to the European Union declined by 54.1 percent to 36,760 net tons.

Exports grew by 7.8 percent from December to January, and February gave only a tiny amount of that increase back. The strong dollar has been applying downward pressure on exports, but it has lost a bit of ground recently to the Canadian dollar and the Mexican peso, though the exchange rate remains well above the level of a year ago. If “peak dollar” has come and gone, and if the economies of Canada and Mexico perform well in 2016, there could be significant growth in exports this year. But those ifs are huge.

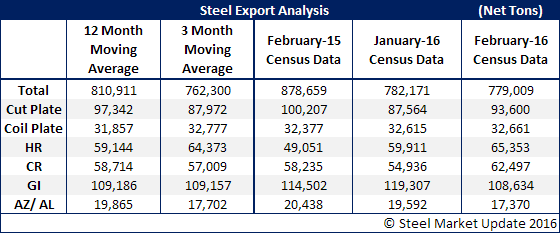

The table below is from Steel Market Update research: