Market Data

May 19, 2016

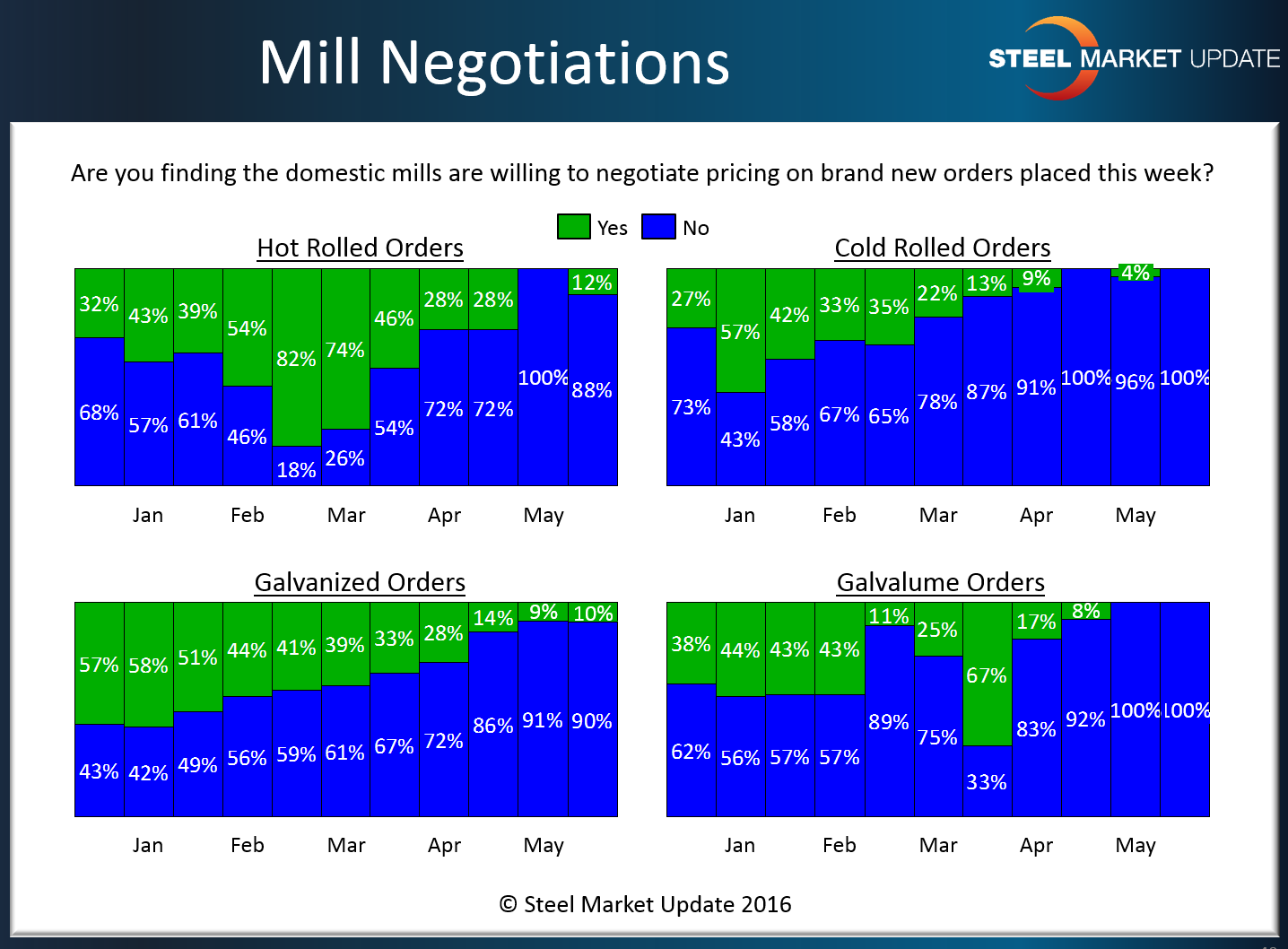

Steel Mills to Customers: Forget Negotiating Steel Prices

Written by John Packard

As the thunderstorms erupt around our offices one of our indices is quite calm. The calming blue color of our bar graph depicts what buyers and sellers are telling us is happening during the negotiation process between mills and their customers: take it or leave it. Respondents to our mid-May flat rolled steel market trends analysis reported almost unanimously that there is virtually no negotiating flat rolled steel prices with the domestic steel mills at this time.

Both Galvalume and Cold Rolled were reported to have zero negotiating room while hot rolled (12 percent) and galvanized (10 percent) barely registered on our graphic. We will let the graphic tell the story.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.