Prices

August 2, 2016

SMU Price Ranges & Indices: Waiting and Watching

Written by John Packard

A couple of the steel mills SMU spoke with today reported their coated order books as being close to closed for September. They reported that there is not a need to make any price adjustments. At the same time, both the mills we spoke with, as well as steel buyers around the country, are anxiously waiting to see what the US Department of Commerce announces at the end of the week when they are scheduled to report their final determination on hot rolled dumping. The expectation is for no change from the preliminary results (see next article in tonight’s issue), but a surprise in one direction or the other could impact prices.

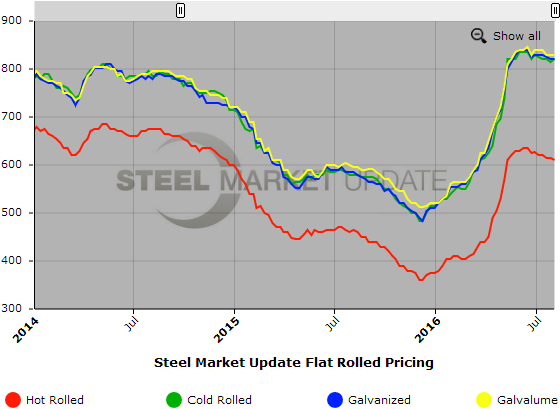

Flat rolled steel prices were basically stable for the week although we did see a very slight reduction in hot rolled caused by a reduction in the top line of the price spread. We have been stuck in a very tight trading range and that continues for yet another week.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $590-$630 per ton ($29.50/cwt- $31.50/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $5 per ton over last week. Our price momentum on hot rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Hot Rolled Lead Times: 2-4 weeks

Cold Rolled Coil: SMU Range is $800-$840 per ton ($40.00/cwt- $42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end remained the same. Our overall average is up $5 per ton over one week ago. Our price momentum on cold rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU Base Price Range is $40.00/cwt-$42.00/cwt ($800-$840 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged over last week. Our price momentum on galvanized steel is for prices to be range bound (+/- $20 per ton) over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $860-$900 per net ton with an average of $880 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU Base Price Range is $40.00/cwt-$43.00/cwt ($800-$860 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Our price momentum on Galvalume steel is for prices to be range-bound (+/- $20 per ton) over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1091-$1151 per net ton with an average of $1121 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.