Prices

September 1, 2016

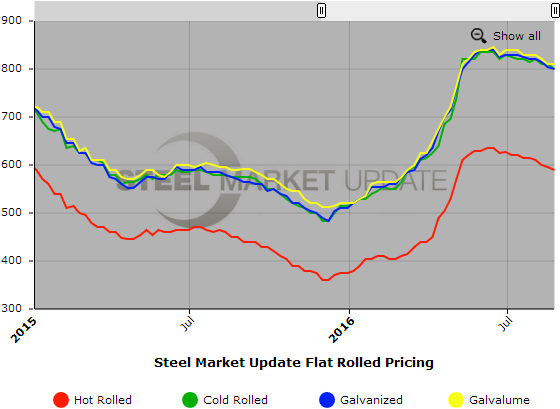

SMU Price Ranges & Indices: Prices Drop by Double Digits on All Products

Written by John Packard

Steel Market Update intentionally did not solicit flat rolled steel price information during our Steel Summit Conference which was held on Monday through Wednesday of this week. Today, as we canvassed the market, we found a significant reduction in prices on all products. We heard reports of “slab rollings” at, or slightly below, $500 per ton. However, we do not take slab rollings into consideration in our price calculations as these are one time deals and do not represent everyday spot prices. We did see reductions in all products this week and every single flat rolled steel item we index was lower by a minimum of $10 per ton to as much as $30 per ton. These are big moves compared to the $5 and $10 movements we had been reporting in previous weeks.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $530-$590 per ton ($26.50/cwt- $29.50/cwt) with an average of $560 per ton ($28.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $40 compared to one week ago while the upper end decreased $20 per ton. Our overall average is down $30 per ton over last week. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $770-$810 per ton ($38.50/cwt- $40.50/cwt) with an average of $790 per ton ($39.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week as did the upper end of our range. Our overall average is down $10 over one week ago. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $38.00/cwt-$40.00/cwt ($760-$800 per ton) with an average of $39.00/cwt ($780 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago as did the upper end of our range. Our overall average is down $20 over last week. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $820-$860 per net ton with an average of $840 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $38.50/cwt-$40.50/cwt ($770-$810 per ton) with an average of $39.50/cwt ($790 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 compared to last week while the upper end decreased $30 per ton. Our overall average is down $20 per ton over one week ago. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1061-$1101 per net ton with an average of $1081 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.