Market Data

September 8, 2016

Steel Mills Willing to Negotiate Flat Rolled Spot Pricing

Written by John Packard

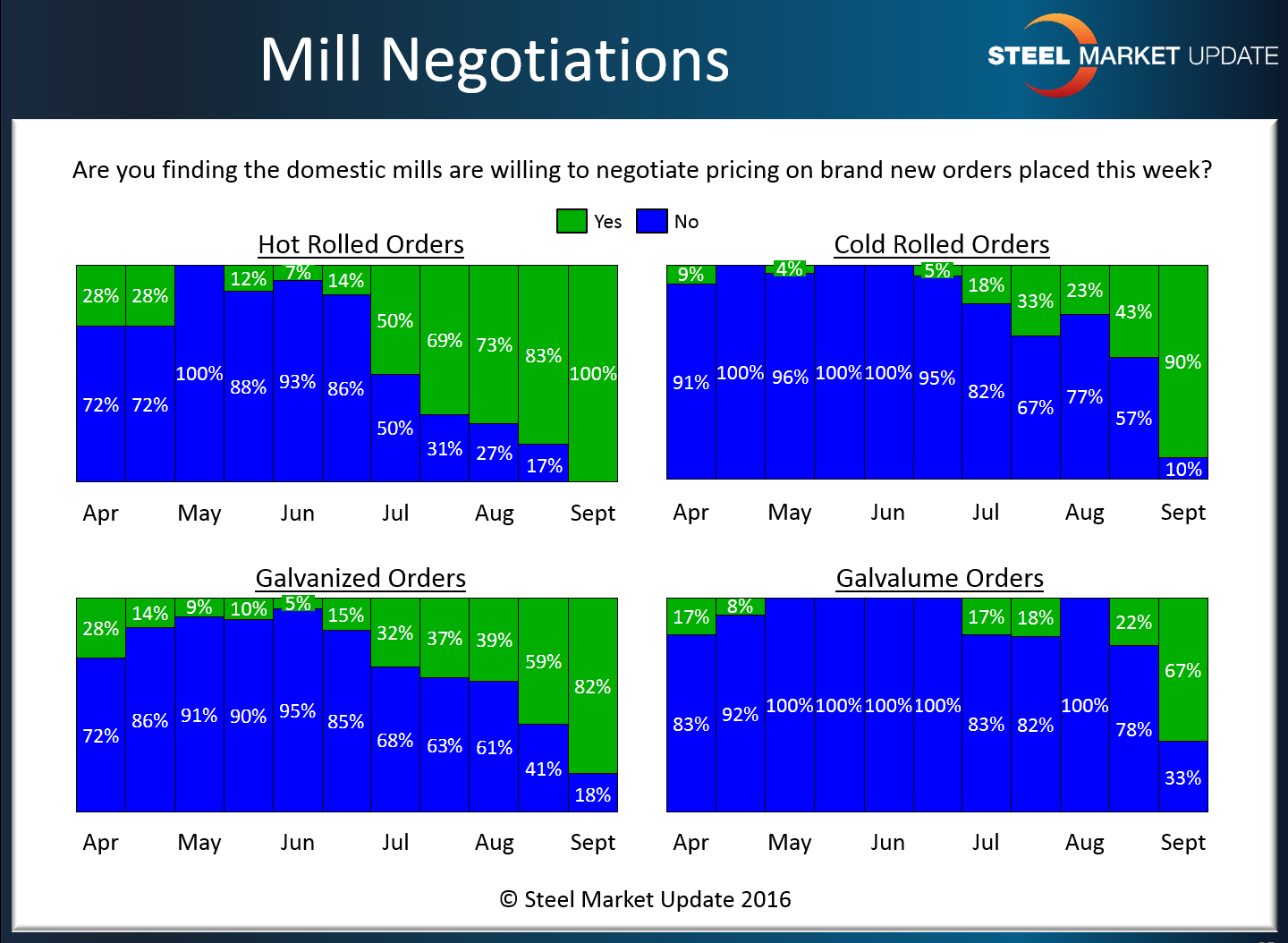

With lead times shrinking on hot rolled, cold rolled, galvanized and Galvalume steels it would be normal to collect data suggesting the domestic steel mills are becoming more negotiable on the spot pricing. The following information was gathered through our flat rolled steel market trends analysis over the past six days.

We found that the majority of our respondents were finding the domestic steel mills willing to negotiate pricing. The percentage of those responding that HRC was now negotiable went from 83 percent two weeks ago to 100 percent now.

Those reporting cold rolled as negotiable went from 43 percent to 90 percent.

Galvanized went from 59 percent to 82 percent and Galvalume from 22 percent to 67 percent.

Based on what we have found regarding lead times and now negotiations, we continue to believe that flat rolled prices will move lower from here and our Price Momentum Indicator continues to point toward lower spot pricing.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.