Prices

October 4, 2016

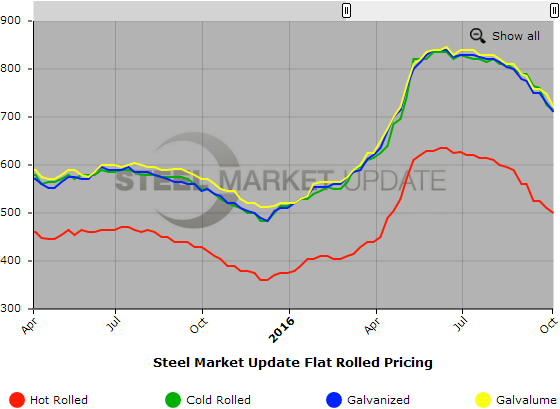

SMU Price Ranges & Indices: Slip Sliding Away

Written by John Packard

Flat rolled steel prices continued their swan dive with hot rolled and cold rolled moving $10 per ton lower and galvanized/Galvalume moving lower by $20 per ton. For the first time in quite awhile SMU picked up information regarding HRC offers down to $460 per ton (with tons). Most buyers, however, were reporting $480 to $520 as where the vast majority of mills were quoting regular “every day” orders (no tonnage attached to the pricing).

Scrap prices are expected to drop this week as negotiations begin in earnest between the domestic steel mills and their scrap suppliers. Look for prices to drop $15 to $40 per ton depending on product and region. The lower scrap prices allow the EAF (mini) mills the flexibility to offer lower prices without giving up margin.

We are hearing from a couple of mills that their order books are good for this time of year. At the same time we are hearing from some buyers that the mills are desperate for business. So, we think the reality is probably somewhere in the middle.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $460-$540 per ton ($23.00/cwt- $27.00/cwt) with an average of $500 per ton ($25.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week while the upper end increased $10 per ton. Our overall average is down $10 over last week. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $690-$740 per ton ($34.50/cwt- $37.00/cwt) with an average of $715 per ton ($35.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week and the upper end decreased $10 per ton as well. Our overall average is down $10 over last week. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$37.00/cwt ($680-$740 per ton) with an average of $35.50/cwt ($710 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $20 over one week ago. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $740-$800 per net ton with an average of $770 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt ($700-$740 per ton) with an average of $36.00/cwt ($720 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $35 per ton compared to one week ago while the upper end decreased $20 per ton. Our overall average is down $27.50 over one week ago. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $991-$1031 per net ton with an average of $1011 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.