Prices

October 18, 2016

SMU Price Ranges & Indices: How Much Further Do We Have to Go?

Written by John Packard

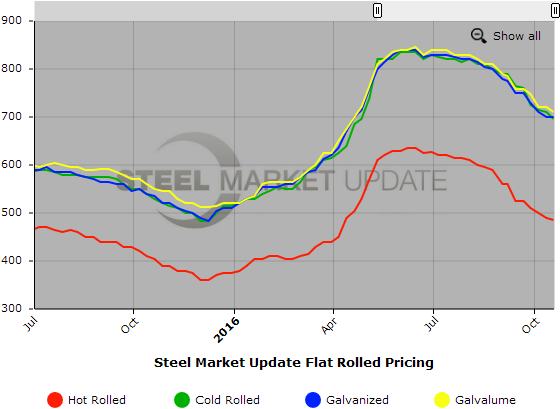

Flat rolled steel prices were mixed this week with three of the four items moving lower and one (galvanized) remaining the same. The questions being asked by buyers – both at the service center and manufacturing level – is how much further do prices need to fall before bouncing back?

The issue of “finding the bottom” is a big one to buyers who are trying to lock in the lowest priced inventories as possible as we head into the New Year. We are hearing that inquiries are high at a number of steel service centers but buyers are still skeptical. We are also hearing that the domestic steel mills are offering prices better than what we have published below for “major” tons and for a specific piece of business. We have chosen to keep those prices out of our index as they do not necessarily represent “spot” prices which are readily available in the industry.

We saw hot rolled prices as slightly lower this week but as we reported last week there are some $440 per ton ($22.00/cwt) numbers out there and if we find enough evidence we will adjust our HRC index later this week.

Cold rolled and Galvalume prices are also seen as lower than what we reported one week ago.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $460-$510 per ton ($23.00/cwt- $25.50/cwt) with an average of $485 per ton ($24.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end decreased $10 per ton. Our overall average is down $5 over one week ago. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $670-$720 per ton ($33.50/cwt- $36.00/cwt) with an average of $695 per ton ($34.75/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton over last week while the upper end dropped $20 per ton. Our overall average is down $15 per ton over last week. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$36.00/cwt ($680-$720 per ton) with an average of $35.00/cwt ($700 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $740-$780 per net ton with an average of $760 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $34.50/cwt-$36.50/cwt ($690-$730 per ton) with an average of $35.50/cwt ($710 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago, as did the upper end of our range. Our overall average is down $10 per ton over last week. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $981-$1021 per net ton with an average of $1001 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.