Prices

October 23, 2016

US Steel, Nucor & CSI Announce Flat Rolled Price Increases

Written by John Packard

On Friday morning US Steel became the first domestic steel producer to announce a flat rolled steel price increase. Later in the day Nucor and California Steel Industries (CSI) followed with similar announcements. SMU expects other steel mills to follow with announcements of their own as this new week gets underway.

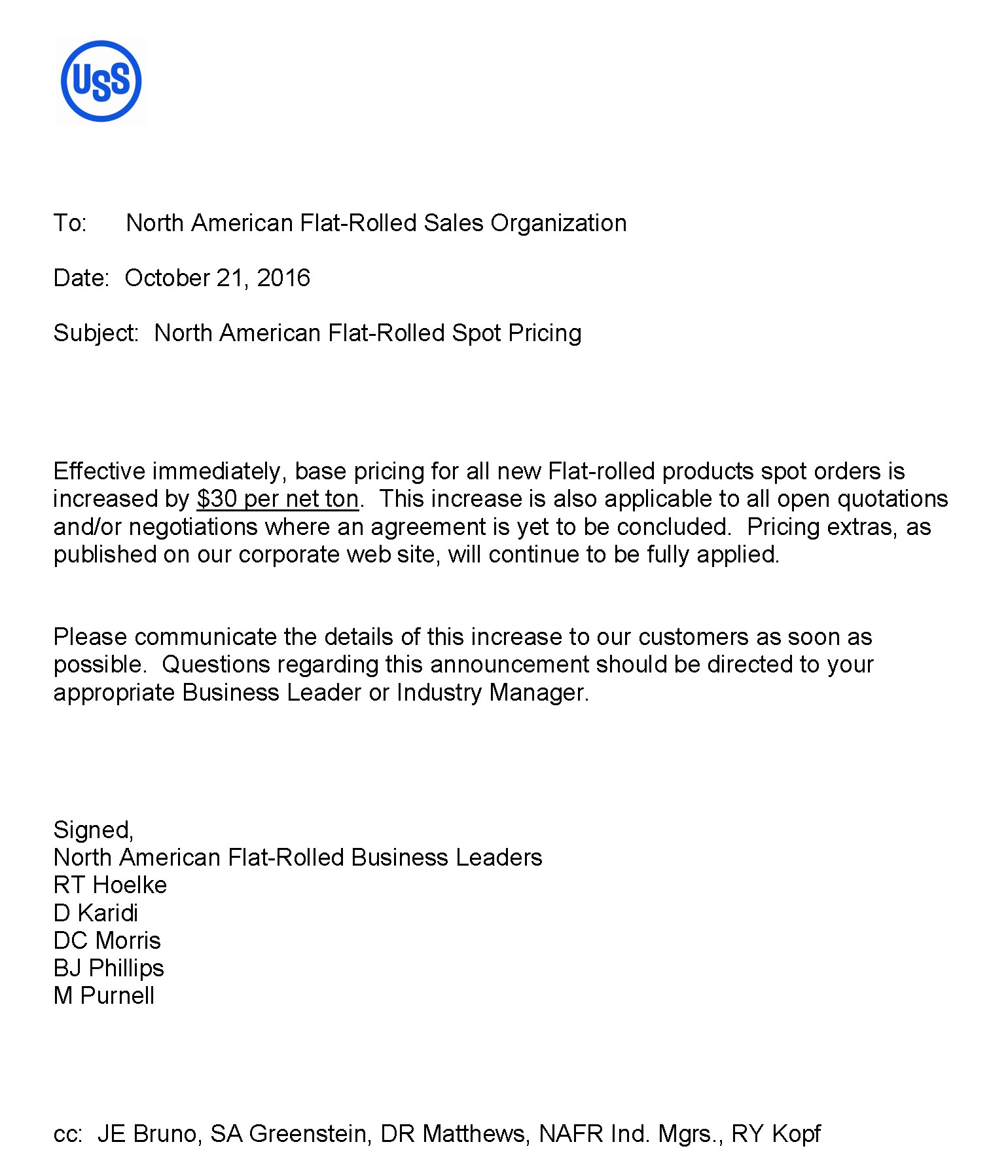

On October 21, 2016 US Steel announced a $30 per ton price increase on all flat rolled steel products (hot rolled, cold rolled, galvanized, Galvalume) effective immediately. According to the US Steel letter (copy shown below) the increase is to be applied to all spot orders where quotations and negotiations have not yet been completed.

This attempt by US Steel to raise flat rolled prices follows an attempt by the Nucor Plate Group to increase prices on plate products 10 days ago (October 11, 2016), also by $30 per ton. So far we have not seen other plate mills following Nucor.

This attempt by US Steel to raise flat rolled prices follows an attempt by the Nucor Plate Group to increase prices on plate products 10 days ago (October 11, 2016), also by $30 per ton. So far we have not seen other plate mills following Nucor.

The initial reaction received from steel buyers on Friday morning is they expect other flat rolled mills to follow the US Steel lead. However, if the lead times do not change it will be difficult for the mills to collect the increases during the fourth quarter.

One large hot rolled service center told us shortly after the US Steel announcement was made, “Had it been for production delivery coming into Q1, I would have expected people to jump on it. However, Q4 is slow and we haven’t seen any signs of demand picking up.”

A large service center told SMU that the US Steel increase announcement was essentially irrelevant to spot buyers of flat rolled products since USS is not a large player in the spot markets. We were told the key would be to see if Nucor and ArcelorMittal follow the US Steel lead. A few hours later Nucor sent out their price announcement taking hot rolled, cold rolled and galvanized products up by $30 per ton (same as US Steel).

California Steel sent out an email price announcement to their customers with the title, “December Price Announcement.” In the letter CSI followed the lead of US Steel and announced that they would be increasing transaction prices, effective immediately, by a minimum of $30 per ton.

From our perspective (SMU) these will be the keys to the success of this announcement: 1) The other domestic mills follow with increases of their own, 2) Steel buyers, especially OEM’s come off the sidelines and begin placing late fourth and early first quarter orders, and 3) Lead times move out of fourth quarter and into first quarter, As lead times extend this prompts buyers to return to the market to cover needs and protect their inventories.