Market Data

November 22, 2016

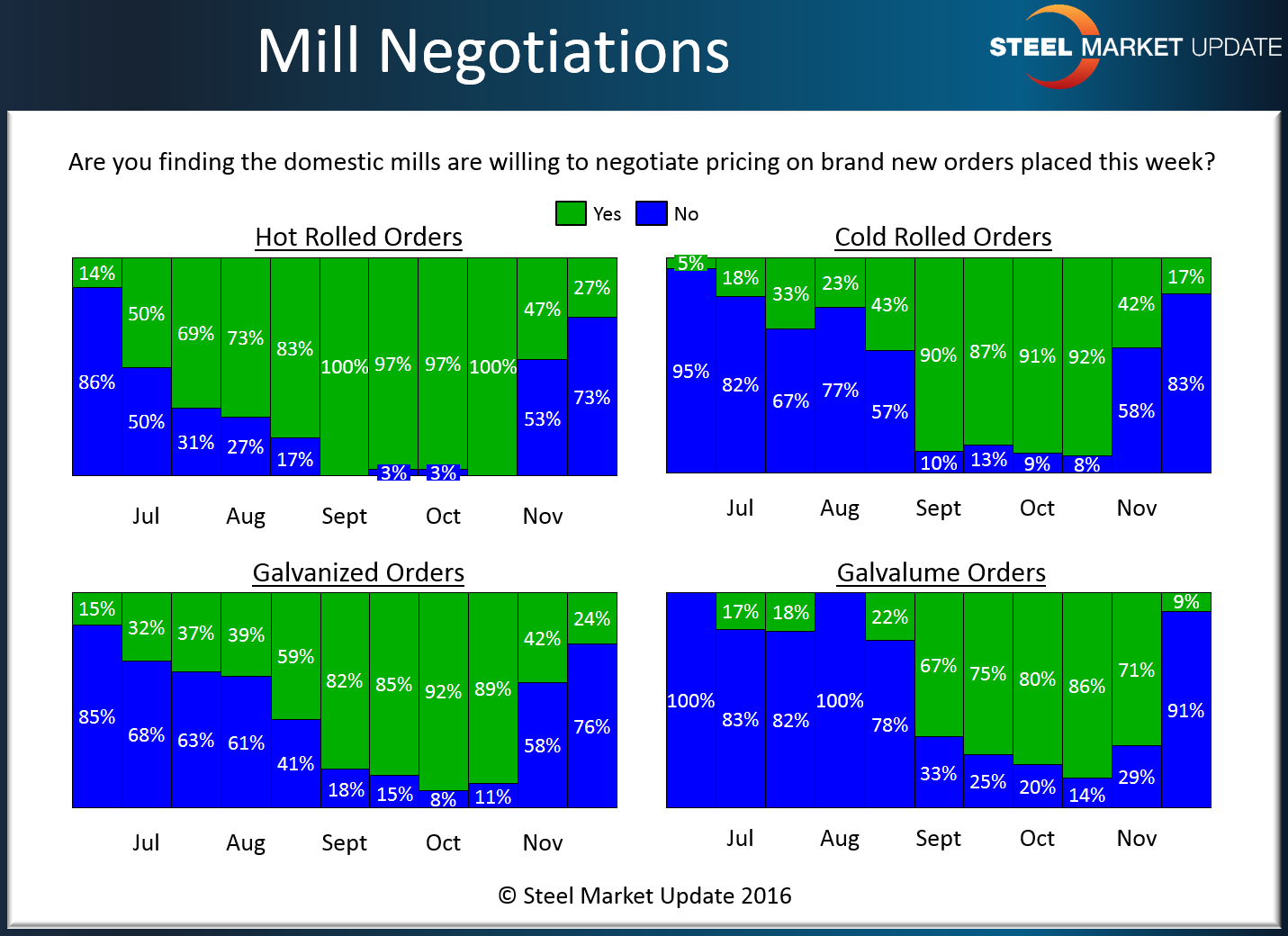

Want to Negotiate Steel Prices? Forget About It…

Written by John Packard

We are being a bit facetious when we tell steel buyers to “forget about it” when asked if the steel mills are willing to negotiate flat rolled steel prices. According to those taking our mid-November flat rolled steel market trends survey, the percent of buyers reporting the mills as willing to negotiate has dwindled from the 80 to 100 percent being reported one month ago to 27 percent or less.

Twenty seven percent of our respondents reported the domestic mills as willing to negotiate hot rolled pricing. Hot rolled has been the weakest product for some time due to weakness in the energy, agriculture and large equipment markets. That weakness has not disappeared but the willingness to negotiate has radically changed.

Those reporting the domestic mills as willing to negotiate cold rolled pricing has dropped from 92 percent one month ago to 17 percent today.

Galvanized negotiations have also dropped radically from 89 percent one month ago to 24 percent this week.

Only 9 percent of our respondents are reporting the domestic producers of Galvalume steels as willing to negotiate steel prices. This is 77 percentage points lower than just one month ago.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.