Prices

November 27, 2016

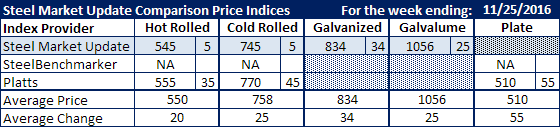

Comparison Price Indices: Pace of Increases in Question but Direction is Not

Written by John Packard

Flat rolled steel prices continued their march higher this past week with both SMU and Platts reporting movement in the average prices of hot rolled, cold rolled, galvanized, Galvalume and plate products.

Platts moved their prices by large double digits this past week. Platts took hot rolled up $35 per ton, cold rolled up $45 per ton and plate up $55 per ton.

Steel Market Update (SMU) was more measured based on the results of our mid-November market trends survey which was completed just before the Thanksgiving Holiday in the United States. The SMU hot rolled number was up $5 per ton to $545 per ton, cold rolled was also up $5 per ton to $745 per ton.

Galvanized products were impacted in two ways: the base price rose but at the same time the new coating extras also came into play. The coating extra change on .060″ G90 represented $9 per ton of the $34 per ton movement we reported this past week.

Galvalume prices increased by $25 per ton with .0142″ AZ50, Grade 80 now averaging $1056 per ton ($52.80/cwt).

Platts discrete plate prices now average $510 per ton and are up a whopping $55 per ton in one week’s time.

SteelBenchmarker did not report prices this past week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.