Prices

November 29, 2016

SMU October & November Import Analysis

Written by John Packard

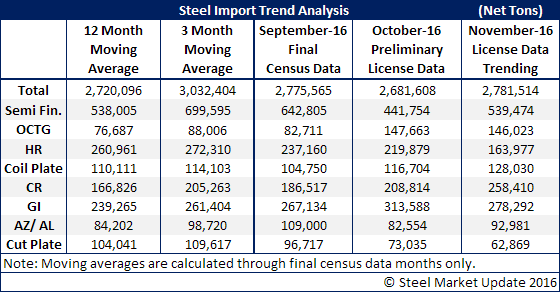

The U.S. Department of Commerce (DOC) reported Preliminary Census Data for the month of October which came in at just under 2.7 million tons (2,681,608 net tons). At the same time the DOC updated license data which we warned last week was being over-stated at close to 3.0 million net tons. According to the license data through today (Tuesday,l November 29th) November is in line with the previous two months at just over 2.7 million net tons.

Both October and November saw fewer semi-finished tons imported into the United States. Other items of note:

Hot rolled is well below the 12 month moving average (12MMA) and 3 month moving average (3MMA). Cold rolled is higher than the 12MMA and 3MMA in both October and November. Galvanized was way up in October at 313,588 net tons (70-90,000 tons above the averages). November GI came down slightly but is still above both 12MMA and 3MMA. Galvalume continues at high rates.

Our readers know (or should know) that China has been accused by the domestic steel industry of circumventing the duties applied against Chinese hot rolled, cold rolled and galvanized by shipping substrate to Vietnam, which prior to the Chinese being hit with AD/CVD dumping duties, was not a supplier of flat rolled steel to the United States. Vietnam will have shipped approximately 39,000 tons of galvanized to the U.S. in both October and November. When looking at cold rolled (which is a smaller market than galvanized here in the U.S.) Vietnam will have delivered 40,000 tons in October and has licenses for 66,000 tons in November. Remember that the circumvention analysis is looking only for Vietnamese steel with Chinese substrate…

There are no Russian cold rolled tons and haven’t been any going back to November 2015. This will change soon. Look for Russian cold rolled to come into the U.S. market over the next couple of months.