Overseas

December 13, 2016

China Weekly Update: Steel, Iron Ore, Coke

Written by John Packard

The following report on the Chinese steel markets comes to SMU from Beijing Metal Import & Export Company,Ltd.:

Please allow us to update China steel market (Dec 05 – Dec 11, 2016) as usual as following:

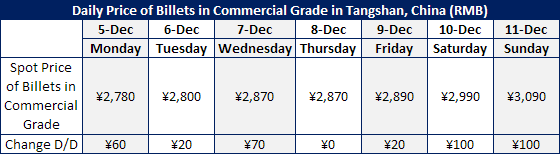

In past week, China market still very firm! Iron ore, coke and Billets all touched the highest level in this year. High cost of raw materials forced steel mills to keep to increase the EXW price. At the same time, government issued several policies i.e shut down all the Medium Frequency Furnaces, hunt down and punish illegal steel mills, strengthen law enforcement surveillance on environmental protection etc. Market was triggered worry due to low stock/shortage of supply.

Under current situation, steel mills are standing at the crossroads again. We all know market is up to real demand so non-market factors can’t give market long time supports. Till now the real demand is still not changed and current market is irrational. As the producer, steel mills should low down EXW prices in order to make market stable but mills have to choice to increase EXW prices due to high costs.

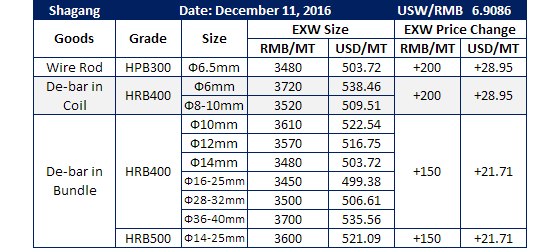

As the biggest private steel mills in China, Shagang released new prices for 2nd ten days of Dec on Sunday. Wire rod up RMB200/MT and De-bar up RMB150/MT.

Price of 2nd grade Coke in Tangshan – RMB2130/MT, unchanged for 3 weeks, which is the highest price in 2016 (lowest price is RMB960).

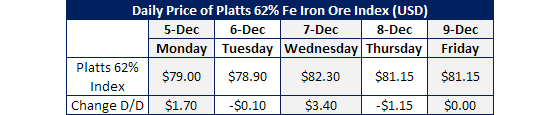

Platts 62% Index, touched highest level at USD82.3/MT(lowest price is USD39.25/MT in this year).

Below price details of Platts 62% index and spot Billets for your information:

Below details of EXW prices from Shagang also for your information:

For EXW prices, some clients send message to say the EXW prices in USD has a big gap with our export offer. Herewith please allow me to further explain as follows:

Please note that EXW prices only for China domestic market and VAT included. For export, no matter HR or CR steel productions, the exporter can enjoy export rebate (9% or 13%), hence export offer price is lower than domestic price. We always told our clients in this year that mill’s allocation for export is very tight, the real reason is that domestic market is very firm this year so mills always put their most part of allocation into domestic market in order to earn bigger profit…

Please note we can’t give price indication today as market is changing so fast. All are waiting for Heibe Group/Rizhao/Baowu ext main steel mills to release the new EXW prices, it’s reported that Baowu will increase EXW price heavily.