Prices

December 13, 2016

SMU Price Ranges & Indices: Consolidating Increases

Written by John Packard

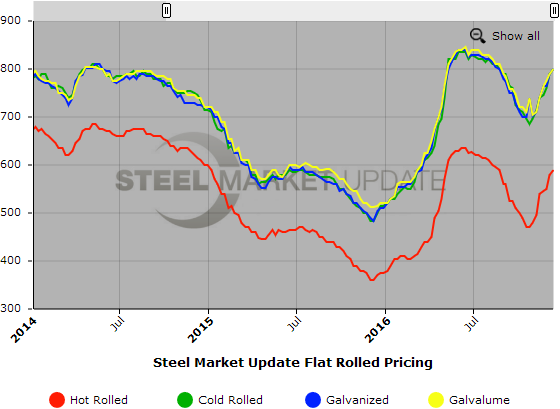

Flat rolled prices rose again this week according to Steel Market Update sources. Our hot rolled, cold rolled, galvanized and Galvalume indices increased by $10 to $20 per ton and are very close to maximizing the increase announcements made two weeks ago. At that time the target was clearly set for $600 per ton hot rolled and $820 per ton base cold rolled and coated. We are within $20 per ton (or less) of the goal on each of the products.

SMU sources are split on whether there will be another price announcement before the New Year. Either way, the expectation is for prices to move perhaps another $40 per ton once we get into early January. One of the triggers for the increase will be higher ferrous scrap numbers.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $580-$600 per ton ($29.00/cwt-$30.00/cwt) with an average of $590 per ton ($29.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton over one week ago while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on hot rolled steel continues to be pointing toward Higher which means that prices are expected to move up over the next 30-60 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU Range is $780-$820 per ton ($39.00/cwt-$41.00/cwt) with an average of $800 per ton ($40.00/cwt) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton over last week while the upper end remained the same. Our overall average is up $10 per ton over one week ago. Our price momentum on cold rolled steel continues to point toward Higher which means that prices are expected to move up over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU Base Price Range is $39.00/cwt-$41.00/cwt ($780-$820 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton over one week ago while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on galvanized steel continues to point Higher which means that prices are expected to move up over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $849-$889 per net ton with an average of $869 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU Base Price Range is $39.00/cwt-$41.00/cwt ($780-$820 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton over last week while the upper end remained the same. Our overall average is up $10 per ton over one week ago. Our price momentum on Galvalume steel continues to point Higher which means that prices are expected to move up over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1071-$1111 per net ton with an average of $1091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.