Analysis

December 21, 2016

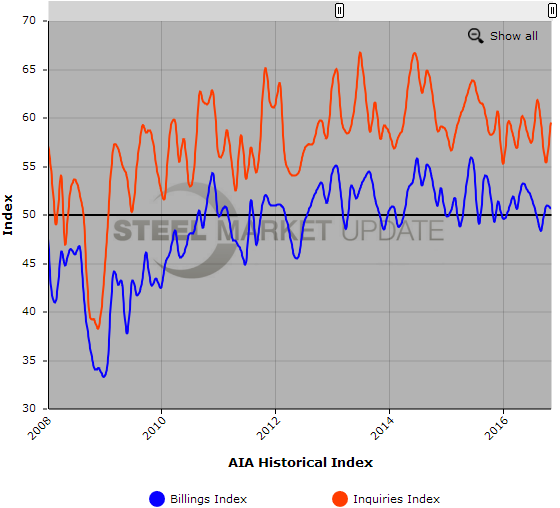

ABI Stays Positive in November

Written by Sandy Williams

The Architecture Billings Index made a small gain in November with a score of 50.6, basically unchanged from October’s reading of 50.8. Any score above 50 indicates an increase in billings for design services. The new projects inquiry index rose to 59.5 from 55.4 in November indicating future growth in construction activity.

“Without many details of the policies proposed, it’s still too early to tell the likely impact of the programs of the new administration,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “However, architects will be among the first to see what new construction projects materialize and what current ones get delayed or cancelled, so the coming months should tell us a lot about the future direction of the construction market.”

Key November ABI highlights:

Regional averages: South (51.3), Midwest (50.9), Northeast (50.8), West (48.6)

Sector index breakdown: multi-family residential (51.7), mixed practice (51.3), commercial/industrial (50.4), institutional (49.5)

Project inquiries index: 59.5

Design contracts index: 50.2

About the AIA Architecture Billings Index

The Architecture Billings Index (ABI), produced by the American Institute of Architects, is considered a leading economic indicator of construction activity, and reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers. The monthly ABI index scores are centered around the neutral mark of 50, with scores above 50 indicating growth in billings and scores below 50 indicating a decline.

Below is a graph showing the history of the AIA Architecture Billings Index and Inquiries Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.