Market Data

January 5, 2017

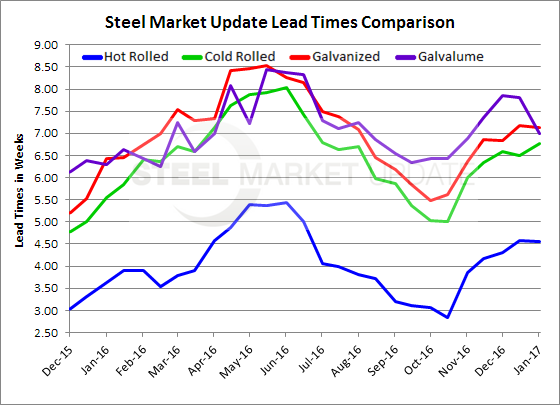

Steel Mill Lead Times Remain “Just Right”

Written by John Packard

Flat rolled lead times remained essentially unchanged from what we reported during the middle of December. Steel mill order books appear to be “good” without creating excessive anxiety at their customers. At the moment, we will call lead times as being not too short and not too long but, just about right…

Since early Tuesday morning Steel Market Update has been canvassing the flat rolled steel market looking for any changes in trends that could impact pricing, supply or demand.

When it comes to steel mill lead times we are looking for changes in the overall market movement and we are not collecting lead times from specific steel mills. We do, however, search by product as hot rolled, for example, could be reacting to market events differently than galvanized or another product.

The data referenced are averages from the cumulated data we receive from our respondents (there are well over 100 respondents).

Hot rolled lead times have been averaging approximately four and one half (4.55) weeks from the time an order is placed until it is promised to ship. At the beginning of November, HRC lead times averaged just under four weeks (3.86 weeks) and one year ago, HRC average lead times were almost one week shorter than what we are reporting today (3.63 weeks).

Cold rolled lead times moved out to six and three quarter weeks (6.77) from the 6.5 weeks we reported during the month of December 2015. At the beginning of November CRC lead times were reported as averaging 6.0 weeks. One year ago, CRC lead times were averaging 5.55 weeks or almost 1.25 week shorter than what we are reporting this week.

Galvanized lead times continued to be just over seven weeks (7.14 weeks) or about the same as what we reported for the middle of December. At the beginning of November GI lead times averaged 6.36 weeks based on those responding to our market trends inquiry this week. One year ago, GI lead times averaged 6.42 weeks.

Galvalume lead times were the only product to shrink in this week’s results compared to our last report which was mid-December 2015. Galvalume is now being reported as averaging seven weeks (7.00) down from 7.80 weeks reported during both the beginning and middle of December. Galvalume is a seasonal product so there should not be a surprise that AZ lead times would come back in a bit during the winter months. One year ago, AZ lead times averaged 6.42 weeks.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.