Prices

February 4, 2017

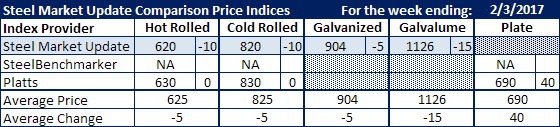

Comparison Price Indices: Flat to Slight Slippage

Written by John Packard

Flat rolled steel prices may have peaked based on the results of the two steel indexes followed by Steel Market Update who reported flat rolled steel prices this past week.

Platts reported prices as remaining the same on all flat rolled products but up $40 per ton on plate.

Steel Market Update (SMU) collected data indicating some erosion in the average of hot rolled (-$10), cold rolled (-$10), galvanized (-$5) and Galvalume (-$15). This was the first week SMU indices showed lower prices which mostly were related to the lower end of the range being reduced and not the upper end changing.

SteelBenchmarker did not report their index averages as they only report prices twice per month.

Please be advised that we have our price ranges and indices in the Pricing section of our website. There you can find base prices as well as benchmark items. The data can be manipulated in a number of ways for those of you who have questions about historical pricing or a specific time frame for comparison purposes. If you need help to find or use the data on our website please contact Brett Linton at Brett@SteelMarketUpdate.com.

SMU Note: Galvanized prices include $69 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.