Prices

February 21, 2017

SMU Price Ranges & Indices: Still Deals Being Made...

Written by John Packard

We had three price announcements and at least one verbal announcement on flat rolled steel since the week began. Everyone is wondering if the other steel mills will follow and what will the base prices be when the dust settles? Based on what we have been hearing from steel buyers today, the suggested minimum base prices ArcelorMittal USA made in January might be the new goal for the latest announcements. ArcelorMittal, at that time, recommended minimum base prices on hot rolled of $640 per ton ($32.00/cwt) and $850 per ton ($42.50/cwt) on cold rolled and coated. So, the latest price increase announcements may be more about ending the slide and moving the needle back to in the favor of the steel mills.

In the meantime, we still have Big River Steel being aggressive on hot rolled. One of the buyers we spoke with today told us about his suppliers, “…by the way, with the exception of coated products, there are deals still being made.”

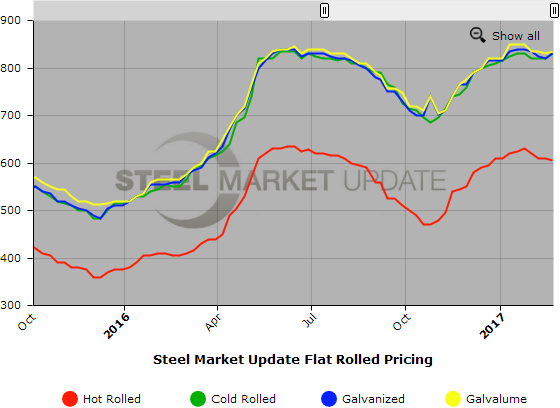

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $580-$630 per ton ($29.00/cwt-$31.50/cwt) with an average of $605 per ton ($30.25/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago while the upper end remained the same. Our overall average is down $5 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU Range is $820-$840 per ton ($41.00/cwt-$42.00/cwt) with an average of $830 per ton ($41.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end remained the same. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Cold Rolled Lead Times: 4-9 weeks

Galvanized Coil: SMU Base Price Range is $41.00/cwt-$42.00/cwt ($820-$840 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on galvanized steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $889-$909 per net ton with an average of $899 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU Base Price Range is $41.00/cwt-$42.50/cwt ($820-$850 per ton) with an average of $41.75/cwt ($835 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end remained the same. Our overall average is up $5 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1111-$1141 per net ton with an average of $1126 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.