Prices

April 2, 2017

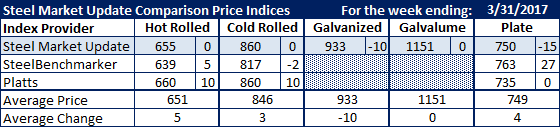

Comparison Price Indices: Mixed Results

Written by John Packard

SMU saw the flat rolled steel markets as flat to slightly down while SteelBenchmarker was mixed and Platts had hot rolled and cold rolled prices increasing by $10 per ton. Sounds like a confusing market but, when looking closer at the actual numbers it really isn’t.

Benchmark hot rolled coil (HRC) was reported to average $655 per ton ($32.75/cwt) on our index with Platts taking their number up $10 to $660 per ton. A $5 per ton spread between SMU and Platts is nothing more than differences in collection techniques and where data came from during the past week. SteelBenchmarker, which only produces their index twice per month, was up $5 from their last report and is now at $639 per ton. This index tends to lag the market (rather dramatically when markets are moving quickly) and could be related to their data providers and when the data was collected.

Galvanized at .060” G90 was lower by $10 per ton while Galvalume .0142” AZ50, Grade 80 remained the same.

Plate prices dropped on the new SMU index as we realized freight was included in some of the numbers we have been collecting. SteelBenchmarker showed plate up $27 from their last pricing to $763 per ton while Platts was stable at $735 per ton for the week.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.