Market Data

April 23, 2017

SMU Flat Rolled Steel Market Trends Analysis

Written by John Packard

Last week, Steel Market Update (SMU) conducted our mid-April flat rolled steel market trends analysis. Over the course of the week we invited 670 individuals representing approximately 650 companies to participate in our survey.

The breakout of the participants was a little different than what we have been seeing over the course of a number of years. In the past, we had a good balance between manufacturing companies and steel service centers with manufacturing companies being a few percentage points larger than the distributors.

Last week, 48 percent of the respondents were service centers, 34 percent manufacturing companies, 7 percent trading companies, 5 percent steel mills, 5 percent toll processors and 1 percent representing suppliers to the industry.

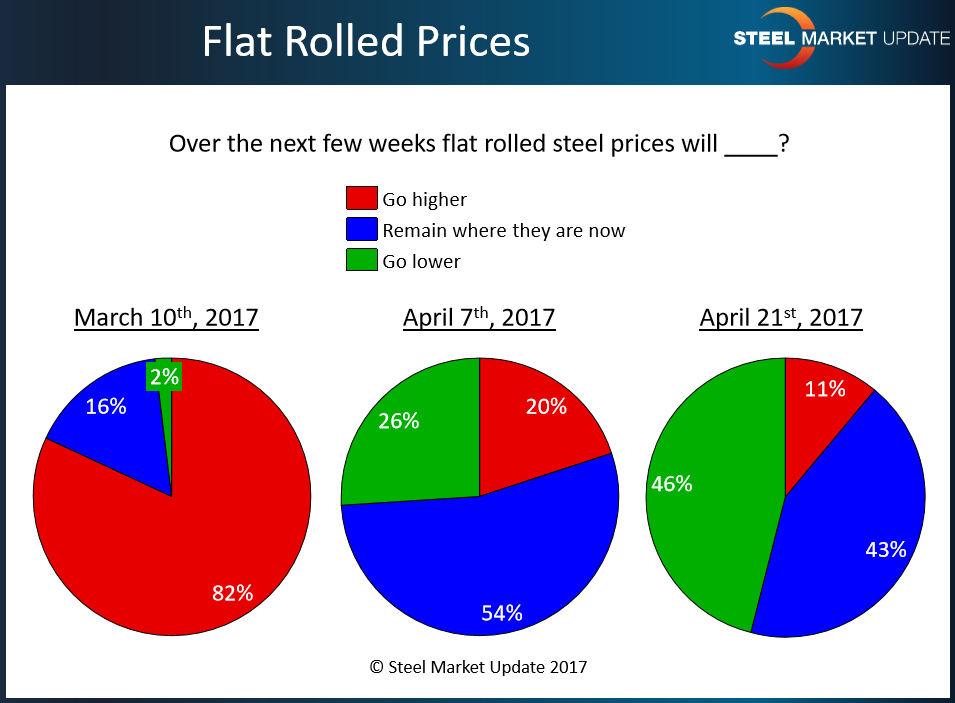

Right up front we asked the entire group of respondents from all segments of the industry to react to a couple of questions about the direction of flat rolled steel prices. The industry appears to still be in transition and leaning toward prices moving lower from here as that is the one response that grew from where we were at the beginning of the month. We have 46 percent (vs. 26 percent on April 7) of the opinion steel prices will go lower over the next few weeks. Those thinking prices will go higher shrunk from 20 percent at the beginning of the month to 11 percent this past week. Those believing prices will remain the same dropped by 11 percentage points to 43 percent from 54 percent.

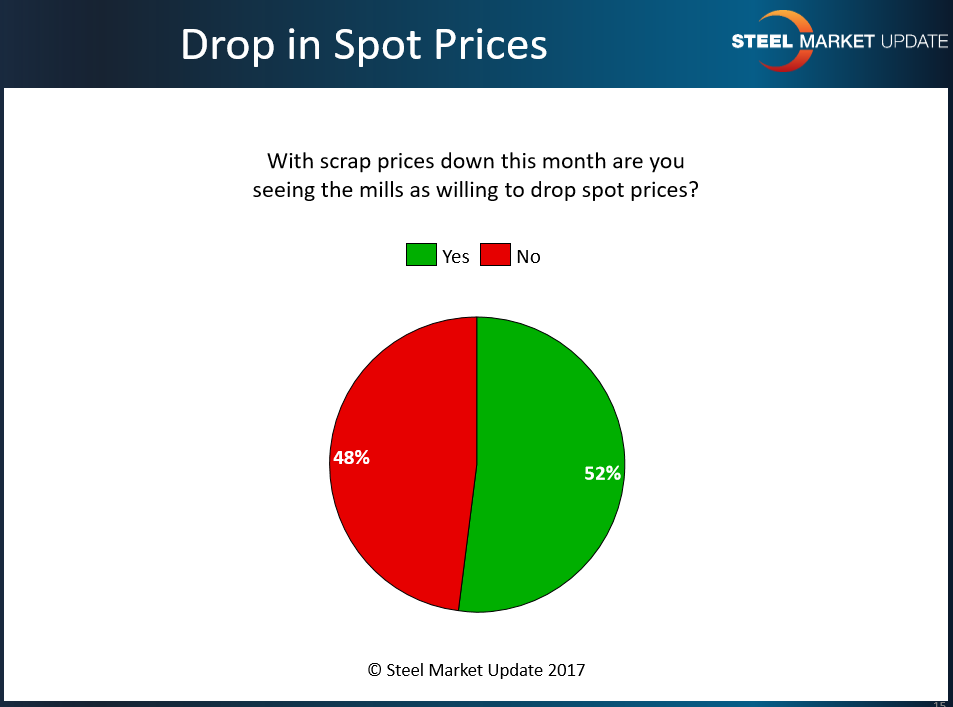

We saw a split reaction to our question regarding what impact scrap prices would have on spot flat rolled pricing. Slightly more than half (52 percent) believe mills are willing to drop spot prices because of the fact ferrous scrap prices fell earlier this month. The balance (48 percent) do not feel the mills will react to scrap pricing.

We have many responses that we share with our Premium level members (which includes those on a free trial to our newsletter and all of the SFIA members who joined us late last week). You can access the surveys on our website (must be logged into the website to access surveys). Under the Analysis tab you will find “Survey Results” and toward the bottom of that list you will find “Latest Survey Results” and “Survey Results History.” Again, you must be logged into the website in order to access these items.