Prices

April 25, 2017

SMU Price Ranges & Indices: Moving Lower from Here?

Written by John Packard

We have an unusual market. What Steel Market Update is seeing is confidence by most of the steel mills. They feel there may be some minor adjustments in spot pricing as a few mills jockey to maintain their order books. At the same time, most steel buyers are being supportive of the price levels we are reporting this week as potentially being the bottom of the market. We are hearing from others buyers that we should anticipate as much as a $50 summer adjustment lower to be followed by another $50 adjustment at the end of the calendar year (November & December).

One mill told me today, “Still getting orders at same prices. My expectation is for decrease BUT if people are buying I am not going to hurry and cut anything. Again, you know i am an optimist on the trade front and I think that later this summer things could tighten up again. Price erosion for short term and potentially followed by firmer than expected numbers due to certain catalysts.”

While a large service center said, “Prices are all over the map depending on mill and products…Real Choppy.”

SMU is of the opinion that prices will “erode” over the next month or two. We will have to wait and see what happens to ferrous scrap prices next week when negotiations for May begin in earnest. The expectation is for sideways to slightly lower scrap prices.

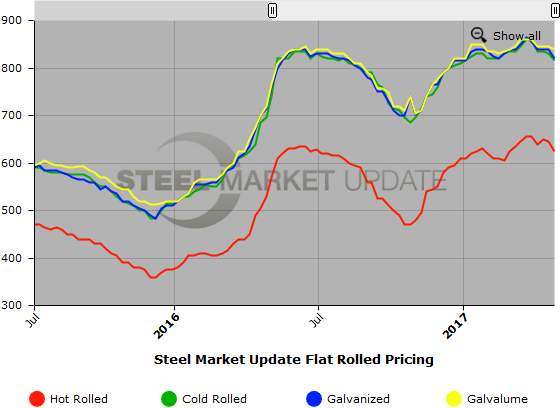

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $600-$650 per ton ($30.00/cwt-$32.50/cwt) with an average of $625 per ton ($31.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago while the upper end fell $10 per ton. Our overall average is down $20 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $790-$840 per ton ($39.50/cwt-$42.00/cwt) with an average of $815 per ton ($40.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week while the upper end declined $20 per ton. Our overall average is down $15 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $39.50/cwt-$42.50/cwt ($790-$850 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $20 per ton compared to one week ago. Our overall average is down $20 per ton compared to last week. Our price momentum on galvanized steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $868-$928 per net ton with an average of $898 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU base price range is $41.00/cwt-$43.00/cwt ($820-$860 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1111-$1151 per net ton with an average of $1131 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $740-$800 per ton ($37.00/cwt-$40.00/cwt) with an average of $770 per ton ($38.50/cwt) FOB delivered. The lower end of our range rose $20 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on plate steel is now pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.