Market Data

May 4, 2017

Steel Mill Lead Times Flat Based on SMU Survey

Written by John Packard

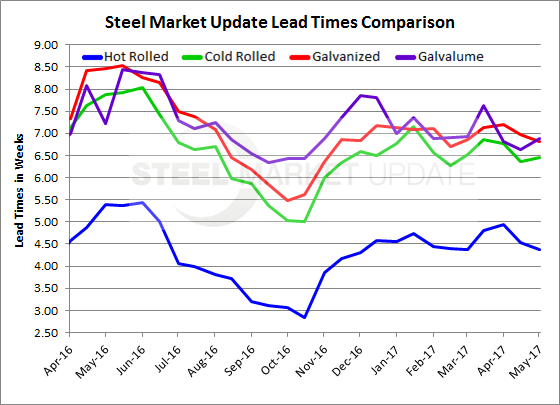

Flat rolled steel lead times are running essentially flat (same as what we have been reporting over the past few weeks) based on the responses we received from manufacturing companies and service centers this week.

Lead time is the amount of time it takes a domestic steel mill to produce a new order if placed today. Lead times are referenced in the number of weeks required and the numbers referenced in this report are the average lead time from all of the responses received in our flat rolled steel market trends analysis conducted this week.

Hot rolled lead times are averaging close to 4.5 weeks (4.37) slightly less than the almost 5 weeks reported in mid-March and early April of this year and significantly shorter than the 5.39 weeks registered at this point last year.

Cold rolled lead times average close to 6.5 weeks (6.46) or about the same as what was reported just a few weeks ago. One year ago, CRC lead times were closer to 8 weeks (7.88).

Galvanized lead times are averaging close to 7 weeks (6.82) which is where we have been over the past four surveys. One year ago, GI lead times averaged 8.47 weeks.

Galvalume lead times averaged close to 7 weeks (6.89) according to those responding to our inquiries. This is close to where we have been over the past couple of months and not too far from the 7.22 weeks reported last May.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.