Market Data

June 11, 2017

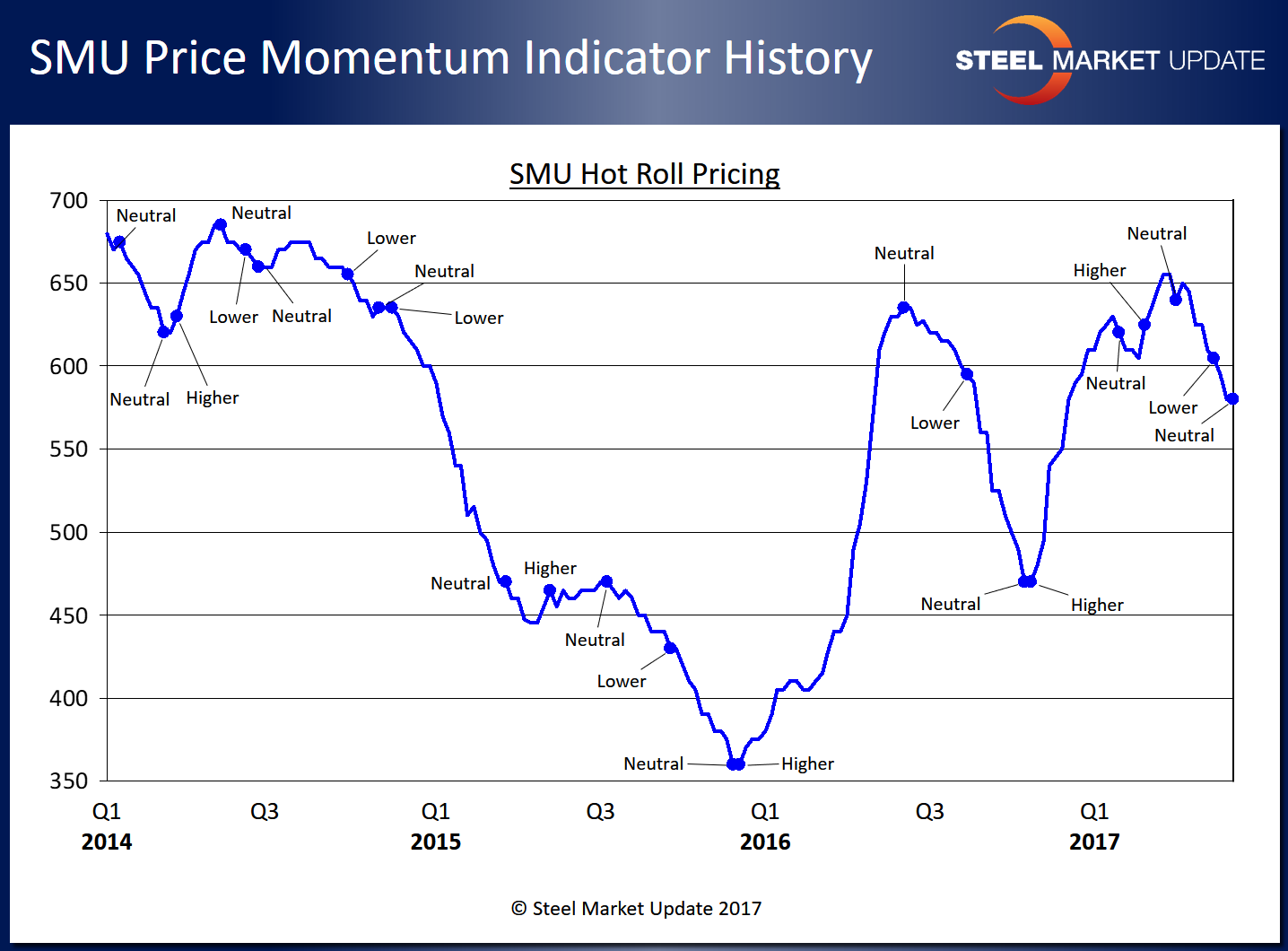

SMU Price Momentum Indicator Now at Neutral

Written by John Packard

Domestic steel mills announced flat rolled steel (hot rolled, cold rolled, galvanized, Galvalume) price increases early last week. However, as is sometimes their want, especially when lead times are shorter than they would like, most of the mills gave their customers time to place orders at the existing prices quoted prior to the announcements.

It is normal procedure for Steel Market Update (SMU) to take our Price Momentum Indicator to Neutral whenever price changes are announced. We do this to ensure that we do not influence the process, and to give the mills and their customers time to negotiate. We did not do this last week due to the grace period most mills were providing to their customers.

![]() One of the smaller mills assisted SMU as we thought about the timing of any potential change in Momentum. We were told last Tuesday, “Nothing new on pricing from our side this week. We have not reduced pricing further and hope that this week we can gather sufficient momentum to turn pricing trends around.”

One of the smaller mills assisted SMU as we thought about the timing of any potential change in Momentum. We were told last Tuesday, “Nothing new on pricing from our side this week. We have not reduced pricing further and hope that this week we can gather sufficient momentum to turn pricing trends around.”

The same mill told us later in the day, “People are really buying a lot today with the deadline looming on existing quotes. Volume’s still hardy, not awesome, but good.”

On Friday of last week, we did move our indicator from “Lower” to “Neutral” as the domestic steel mills tried to take prices higher.

We will continue to evaluate steel prices and Momentum and will advise as soon as we see a lasting trend.