Prices

July 16, 2017

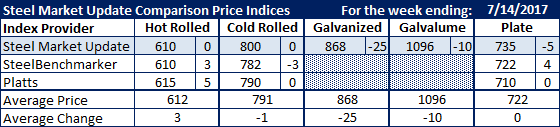

Comparison Price Indices: Another Mixed Week

Written by John Packard

Flat rolled prices were mixed this past week. Early last week we were collecting information from steel buyers who were advising Steel Market Update that steel mill lead times were short and there were still holes in the order books at many of the domestic mills. As the week progressed we found, especially after the Trump comments on tariffs and quotas, the mills as being more committed to keeping prices firm.

Benchmark hot rolled had a very narrow range on the three indices followed by SMU who all reported last week. SMU had our index average as unchanged at $610 per ton ($30.50/cwt) while Platts took their numbers up twice during the week and ending at $615 per ton. SteelBenchmarker reported hot rolled steel prices last week as they do only twice during the month. The SteelBenchmarker HRC average was up $3 per ton to $610 per ton.

Cold rolled prices were unchanged on two of the indexes with SMU coming in at $800 per ton, the highest number of the three indexes. Platts was unchanged at $790 per ton and SteelBenchmarker was down $3 per ton and their average on CRC was $782 this past week.

Galvanized took a big drop as SMU picked up a number of end users and service centers reporting lower base prices on commodity grade coils. We did not see much of this in the northern markets of Chicago and east. The SMU GI average on .060” G90 is now $868 per ton.

Galvalume also slide slightly down $10 per ton ($.50/cwt) for the week with our benchmark .0142” AZ50, Grade 80 item coming in at $1096 per ton.

Plate prices, which we adjusted again on Wednesday in the early AM, was down $5 per ton to $735 per ton. Please note the SMU plate price is freight prepaid (delivered) to the customer and not FOB the mill as it is for SteelBenchmarker and Platts.

SteelBenchmarker had plate up $4 to $722 per ton while Platts was unchanged at $710 per ton.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Southeaster Mill (does not include freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers, we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.