Market Data

July 20, 2017

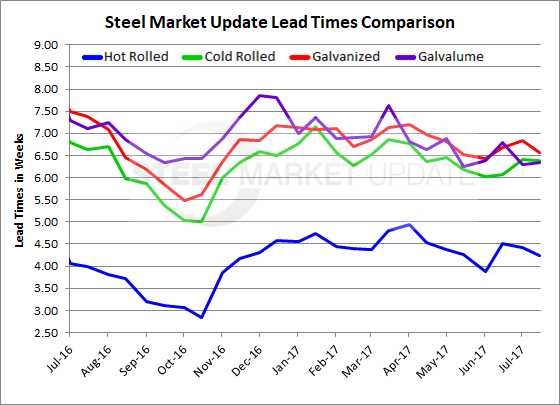

Steel Mill Lead Times Flat

Written by John Packard

Flat rolled lead times remain flat compared to what we reported for early July, as well as one month ago.

Twice per month, Steel Market Update conducts an analysis of the flat rolled sheet and plate markets. This is done through the use of a comprehensive questionnaire focused on manufacturing companies and service centers, which combined account for 86 percent of the total responses received. However, when looking at lead times, we restrict the responses to only manufacturers and distributors. We do not invite steel mills, trading companies and toll processors to participate in our lead time questions.

The lead times we reference below come through our survey process and are an average of the responses seen. For exact lead times from any specific mills, contact your local representatives.

Hot rolled lead times continue to be in the low to mid 4-week time frame (4.25 weeks). This is similar to what we saw one year ago when lead times were reported to be averaging 4.00 weeks.

Cold rolled lead times are approximately 6.5 weeks (6.38 weeks), which is very similar to what we reported one year ago (6.63 weeks).

Galvanized lead times were slightly lower than what we saw at the beginning of this month. This week our average lead time on GI is 6.56 weeks vs. the 6.84 weeks reported at the beginning of the month. One year ago, lead time average on GI was 7.38 weeks.

Galvalume lead times averaged 6.33 weeks, almost the same as what we reported at the beginning of July (6.30 weeks). One year ago, AZ lead times were 7.11 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers that participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace.