Prices

July 25, 2017

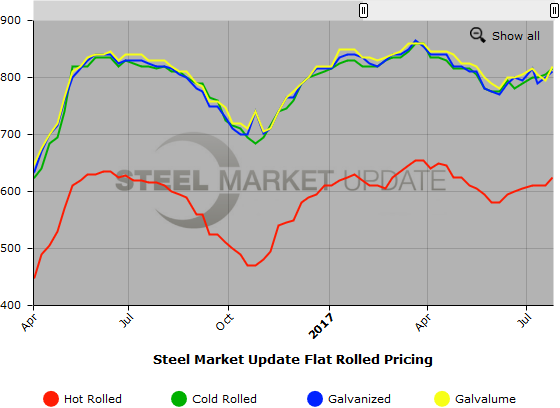

SMU Price Ranges & Indices: Direction is Higher

Written by John Packard

Steel buyers reported the domestic steel mills as being somewhat more receptive to moving prices early this week compared to where they were at the end of this past week. The result being we did see prices rising on all sheet products.

One mill told us earlier today about their coated products order book, “Hanging around $40, still very stable… Pretty much the same price for 45 days. People keep sending orders – particularly end consumers.”

An end user provided some insights as to how they are seeing the market when they shared this with us, “On pricing, various conversations have suggested that they mills are looking for business and negotiable on price for volume. Lead times are short for coated at 4 to 5 weeks, so that tells us something about current market demand.”

We did hear from a plate buyer who told us that we should expect a $30 to $40 per ton price increase on plate products as their mill suppliers were warning that the increases are coming.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $610-$640 per ton ($30.50/cwt-$32.00/cwt) with an average of $625 per ton ($31.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $790-$840 per ton ($39.50/cwt-$42.00/cwt) with an average of $815 per ton ($40.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to last week. Our overall average is up $10 per ton compared one week ago. Our price momentum on cold rolled steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $39.00/cwt-$42.00/cwt ($780-$840 per ton) with an average of $40.50/cwt ($810 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton compared to last week. Our price momentum on galvanized steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $858-$918 per net ton with an average of $888 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU base price range is $39.00/cwt-$43.00/cwt ($780-$860 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end increased $30 per ton. Our overall average is up $25 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,071-$1,151 per net ton with an average of $1,111 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $680-$730 per ton ($34.00/cwt-$36.50/cwt) with an average of $705 per ton ($35.25/cwt) FOB delivered. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end declined $30 per ton. Our overall average is down $20 per ton compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 3-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.