Analysis

September 20, 2017

Existing Home Sales Slump in August

Written by Sandy Williams

Home sales in the South are expected to be dampened for the rest of the year as a result of the hurricanes in Houston and Florida, says the National Association of Realtors.

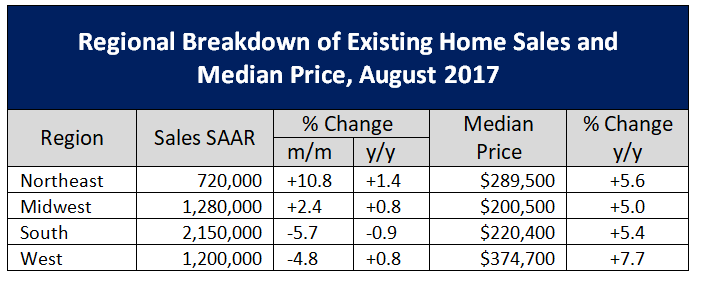

Existing home sales slumped in August to a seasonally adjusted annual rate of 5.35 million, a retreat of 1.7 percent from July and barely above last year’s level.

Median price for all housing types rose 5.6 percent year over year to $253,500. Inventory at the end of August stood at 1.88 million existing homes for sale, down 2.1 percent from July and 6.5 percent below the year-ago total of 2.01 million. At the present sales rate, unsold inventory is at a 4.2-month supply, down from 4.5 months in August 2016.

Single-family home sales fell 2.1 percent, while condominium and co-op sales climbed 1.7 percent. Median price for single-family homes rose 5.6 percent to $255,500 in August.

“Steady employment gains, slowly rising incomes and lower mortgage rates generated sustained buyer interest all summer long, but unfortunately not more home sales,” said Lawrence Yun, NAR chief economist. “What’s ailing the housing market and continues to weigh on overall sales is the inadequate levels of available inventory and the upward pressure it’s putting on prices in several parts of the country. Sales have been unable to break out because there are simply not enough homes for sale.”

Added Yun, “Some of the South region’s decline in closings can be attributed to the devastation Hurricane Harvey caused to the greater Houston area. Sales will be impacted the rest of the year in Houston, as well as in the most severely affected areas in Florida from Hurricane Irma. However, nearly all of the lost activity will likely show up in 2018.”