Market Data

September 29, 2017

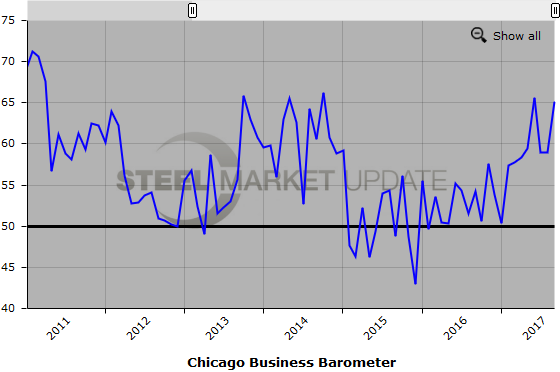

Chicago Business Barometer Soars in September

Written by Sandy Williams

A sharp rise in the September Chicago Business Barometer indicates a strong fourth quarter for manufacturing. The Barometer rose to 65.2 from 58.9 in August for its second highest level in more than three years. The average reading for the third quarter was a solid 61.0, steady with the second quarter’s three-year high of 61.1.

All the components of the index strengthened in September with particularly strong gains in demand, backlogs and employment. The recent storms slowed delivery times somewhat and led to stockpiling of inventory. The inventory index rose by 8.4 points to its highest level since March, said MNI Indicators.

The employment index pulled out of contraction in September, although firms noted a shortage of skilled workers. Temporary staff and overtime hours helped to fill the void.

The hurricanes also boosted gate prices in September to a level equal to July 2011. In a special question asked amid the storms ravaging the Texas and Louisiana area, 58.6 percent said they don’t expect supplier delivery times to change in the fourth quarter and 38 percent thought times would lengthen or were already experiencing some disruption.

“The strong outturn in September means that on a quarterly basis business activity was broadly unchanged from an already impressive Q2. Looking forward, firms are on record expecting a busy Q4 despite disruptions caused by the recent storms, with just a handful expecting delivery times to lengthen between October through December,” said Jamie Satchi, economist at MNI Indicators.

The Chicago Business Barometer, published monthly by MNI Indicators, is a composite diffusion indicator made up of the Production, New Orders, Order Backlogs, Employment and Supplier Deliveries indicators and is designed to predict future changes in U.S. gross domestic product (GDP). An indicator reading above 50 indicates expansion compared with a month earlier, while below 50 indicates contraction. A result of 50 is neutral. The farther an indicator is above or below 50, the greater or smaller the rate of change.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.