Prices

October 17, 2017

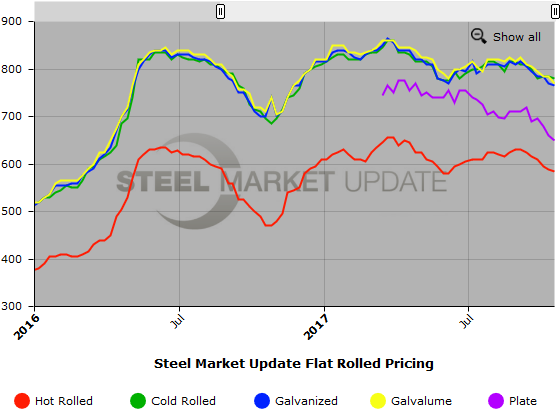

SMU Price Ranges & Indices: Slow Slog South

Written by John Packard

Flat rolled steel prices continued their slow slog south (prices are moving lower). The pace has not accelerated, but there are questions as to whether some of the mills are cutting “quiet” deals in order to fill their fourth-quarter order book without giving the steel away.

One service center put it to us this way: “If you have index contracts, those prices aren’t that attractive, so my guess is some cheaper pricing must be out there to motivate anyone wanting to buy big volume right now. My guess is in the next two weeks there will be a lot of ‘quiet deals’ being done on volume to get December books full. For those who have learned that they can live comfortably with 2 months of inventory, even a so-called ‘deal’ right now isn’t that attractive, considering we could be entering a phase of lower input cost for an extended period.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $560-$610 per ton ($28.00/cwt-$30.50/cwt) with an average of $585 per ton ($29.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end declined $5 per ton. Our overall average is down $2.50 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Lower indicating prices are expected to decline over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU price range is $750-$810 per ton ($37.50/cwt-$40.50/cwt) with an average of $780 per ton ($39.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $5 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Lower indicating prices are expected to decline over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $36.50/cwt-$40.00/cwt ($730-$800 per ton) with an average of $38.25/cwt ($765 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is pointing to Lower indicating prices are expected to decline over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $808-$878 per net ton with an average of $843 per ton FOB mill, east of the Rockies. A note to our readers who also review other galvanized indexes: Right now, not all indexes are using the same G90 zinc coating extra on benchmark .060″ material. SMU uses $78 per ton, while at least one other index is using $86 per ton, which reflects the price change made by NLMK USA. SMU has not yet made a change as we wait for U.S. Steel, ArcelorMittal USA and Nucor to make adjustments to their extras.

Galvanized Lead Times: 3-8 weeks

Galvalume Coil: SMU base price range is $37.00/cwt-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. The lower end of our range fell $20 per ton compared to one week ago, while the upper end declined $10 per ton. Our overall average is down $15 per ton compared to last week. Our price momentum on Galvalume steel is pointing to Lower indicating prices are expected to decline over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,031-$1,091 per net ton with an average of $1,061 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $620-$680 per ton ($31.00/cwt-$34.00/cwt) with an average of $650 per ton ($32.50/cwt) FOB delivered. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $10 per ton over the past week. Our price momentum on plate steel is pointing to Lower indicating prices are expected to decline over the next 30 days.

Plate Lead Times: 3-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.