Analysis

October 20, 2017

Final Thoughts

Written by John Packard

We have an article in tonight’s newsletter from Mario Briccetti that I want to make sure is not misconstrued as a criticism of the domestic steel mills. The Kobe Steel violation of trust by certifying test results for tests that were not conducted has created some unease here in the United States. It is Steel Market Update’s opinion that the U.S. steel mills are conducting all tests and are going the extra mile to ensure their customers are receiving steel as ordered. In my 40+ year career in the industry, I am unaware of a steel mill falsifying a mill certification.

The steel industry consists of much more than just steel mills. There are hundreds of service centers, trading companies, brokers, toll processors, wholesalers and fabricators that can touch steel and then send out certifications. There is a prime steel market and a secondary steel market. It is important to know who you are doing business with. And remember, sometimes there are reasons why the deal is too good to be true….

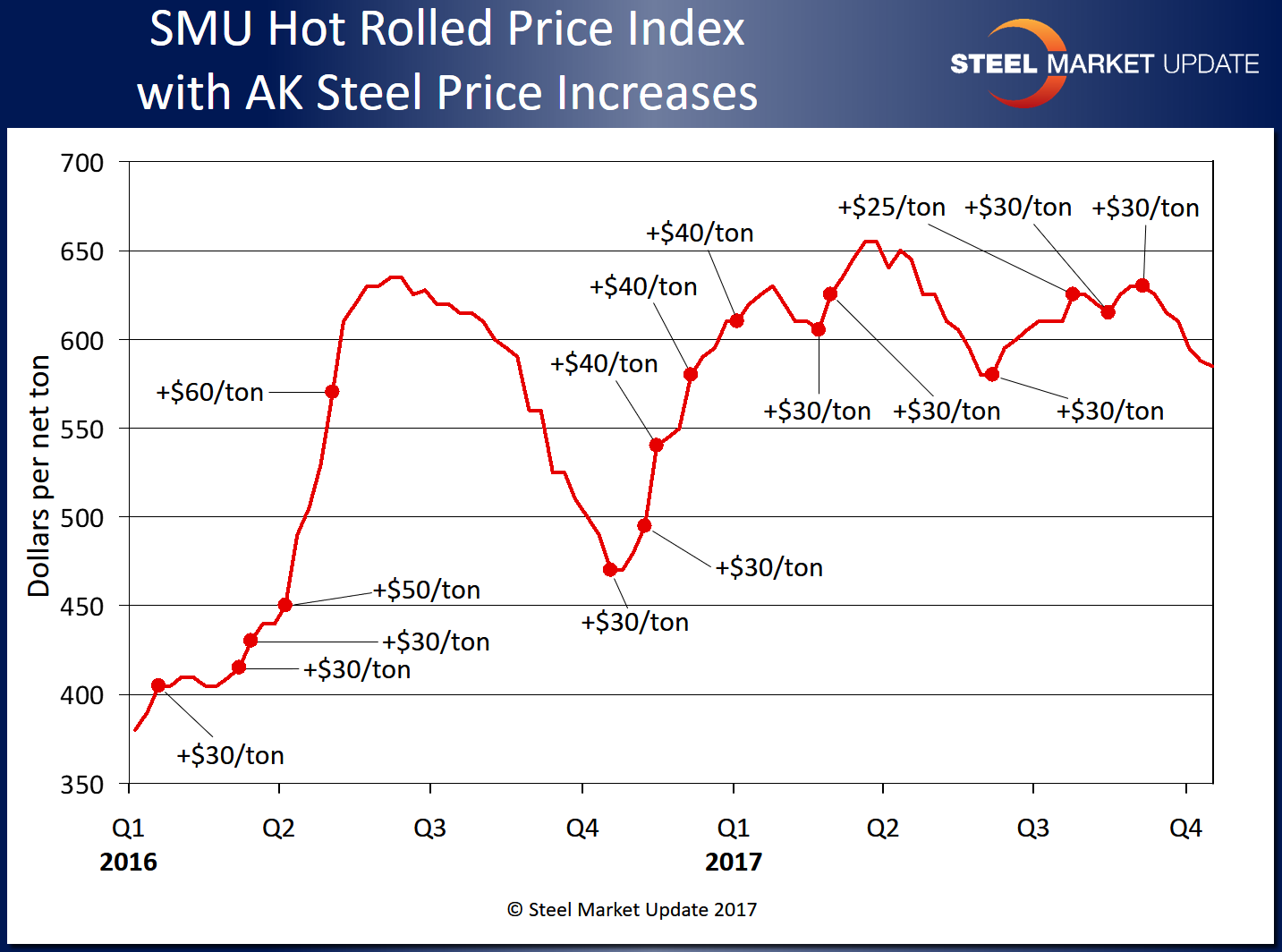

For those of you who are new to Steel Market Update, one of our practices is to take as impartial a position as possible when the domestic steel mills begin raising prices. As you can see by the graphic below, the domestic mills don’t always collect the increases as announced. In fact, many times the increases fall flat and are not collected at all. We use AK Steel as our benchmark for spot flat rolled price increases since they publish all of their increases on their website (www.aksteel.com) in the “news” section of the site. As of Sunday, AK Steel had not yet followed the AMUSA or Nucor lead.

We are aware there are times when Steel Market Update can influence the market and push prices in one direction or the other. We don’t want to do that. We prefer that the market decide what is justified based on supply/demand and perceptions about the industry. One of the first things we do is move our Price Momentum Indicator to Neutral – this is not a rubber stamp that the increase will be collected, just an acknowledgement that the mills are trying to change the dialogue in the market.

We will see what happens as we work on pricing and comments from industry sources on Monday and Tuesday of this week.

As always, your business is truly appreciated by all of us at Steel Market Update.

John Packard, Publisher