Product

October 31, 2017

October 2017 from the Rearview Mirror

Written by John Packard

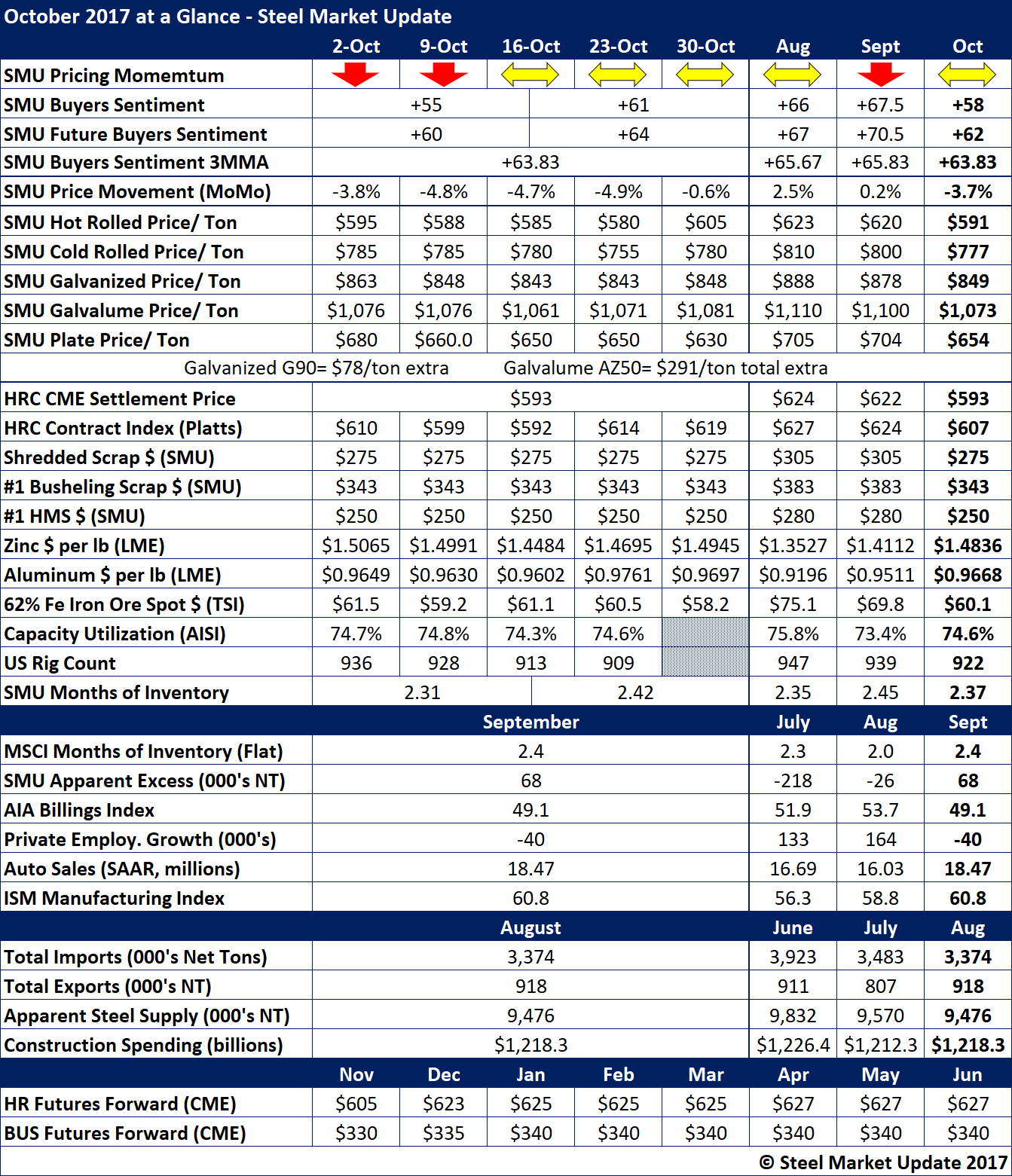

The month of October is now behind us and here are some of the key pieces of data either produced by or followed by Steel Market Update.

As the month ended, our Price Momentum Indicator continues to point toward Neutral (meaning there is not a strong enough “push” to prices that will force them higher or lower from here). We moved our Indicator to Neutral after the domestic mills announced price increases. Prior to that, our Indicator was pointing to lower pricing.

Another proprietary product, the SMU Steel Buyers Sentiment Index, has been drifting lower over the past couple of months as can be best seen in the three-month moving average (3MMA). Our 3MMA is now at +63.83, which is still a very optimistic number. Any positive number (+) indicates an industry that is comfortable with the way business conditions are going and that companies are able to make money.

Hot rolled prices averaged $591 for the month of October with the highest weekly number from this week when we advised that our HRC average is now above $600 per ton and is averaging $605 per ton.

Cold rolled bounced off the lows of the month just as the month closed.

Scrap prices were down significantly at the beginning of October.

MSCI months of carbon flat rolled inventory was reported at 2.4 months, which our proprietary Apparent Excess/Deficit model calculated to be +68,000 tons (essentially balanced).

Zinc is an item that bears watching as the metal traded over $1.50 per pound in late trading this afternoon (Oct 31). Zinc is trading very close to its five-year high of $1.5258 per pound.