Prices

January 14, 2018

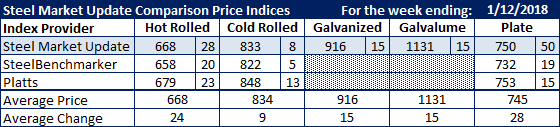

Comparison Price Indices: Strong Weekly Move Higher

Written by John Packard

Flat rolled steel prices moved higher this past week, according to the steel price indexes followed by Steel Market Update. It’s a combination of moving into the New Year and getting the holidays behind us, stronger demand on many products and the steel mills moving to collect some, if not all, of the recent flat rolled price increase ($40 per ton) and plate price increase ($50 per ton). The net result being double-digit movement on almost every item in the table below.

Benchmark hot rolled coil appears to be one of the strongest products, moving $28 per ton on our own index and $23 per ton at Platts and $20 per ton at SteelBenchmarker.

The spread between hot rolled and cold rolled base prices shrunk. The spread, which peaked at +$240 per ton according to our index, is now $165-$167 per ton (SMU and Platts). The normal spread between the two products has been $100-$140 per ton prior to 2017.

Galvanized .060” G90 moved up by $15 per ton, as did Galvalume.

Plate pricing (delivered) was $750 (SMU), $753 (Platts) and $732 per ton (FOB Mill) at SteelBenchmarker.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Mill

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Delivered Midwest (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers, we will include them in the average. The weeks where they do not produce numbers (NA = not available), we will not include their outdated numbers in the CPI average.