Prices

February 1, 2018

U.S. Steel Last to Revise Coating Extras: An Analysis

Written by John Packard

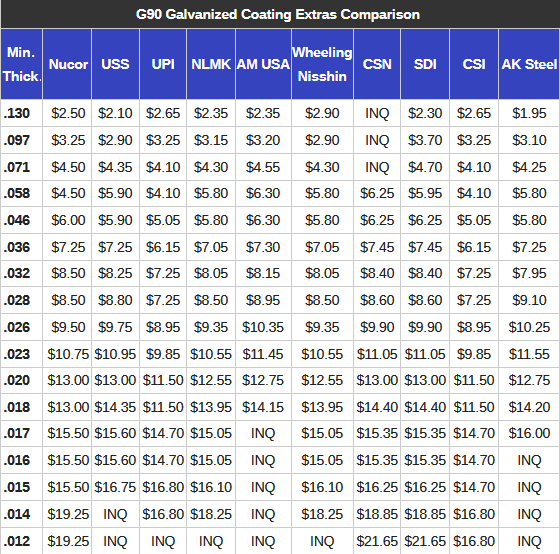

It is not enough to know a steel mill’s base price. When doing a comparison of galvanized transaction pricing, a steel buyer must understand the extras being added to the base price as well as freight and other considerations that could impact the total delivered cost to your facility.

During our Steel 101 workshop we spend time reviewing coating and other extras to help both buyers and sellers of steel realize how easy it can be to leave dollars on the table.

The U.S. Steel zinc coating advantage is no longer in effect. Last week, U.S. Steel advised their customers of their intention to revise their coating extras effective March 1, 2018. The last adjustment made by U.S. Steel was April 1, 2017, and those extras are still showing on their website. SMU did manage to get our hands on the new USS extras, as well as the extras being charged by the other domestic steel mills. We have compared them and found some interesting differences.

For those who buy ultra-light gauge G30 galvanized steels for furnace pipe, corner bead, lighting fixtures, etc., Nucor’s .012 G30 extra is significantly below the published competition. Their extra is $6.75/cwt compared to California Steel Industries (CSI) at $7.80/cwt and Steel Dynamics (SDI) at $9.75/cwt. A $3.00/cwt ($60 per ton) swing from Nucor to SDI.

We are finding that Nucor has the lowest extras for G30 coatings of all of the U.S. steel mills. The highest extras are out of ArcelorMittal USA. Click here to view our table, which compares G30, G60 and G90 extras from the U.S. steel mills.

The West Coast mills – California Steel and USS/POSCO (UPI) have the lowest G90 coating extras.

Note: The mill coating extras and a line item comparison can be found on the SMU website under the resources tab. The G90 table shown in this article is on our website along with G30 and G90 comparisons.