Plate

February 15, 2018

Plate Increase Announced, Will Flat Rolled be Next?

Written by John Packard

Flat rolled and plate steel prices have been on the rise and are expected to continue climbing in the coming weeks. Yesterday, Nucor announced a new $50 per ton ($2.50/cwt) base price increase on plate. Steel Market Update anticipates flat rolled sheet prices will soon follow.

With the latest Nucor announcement on plate the total amount of the increases is $280 per ton ($14.00/cwt) since Nov. 1, 2017. Other plate mills are expected to follow the Nucor lead.

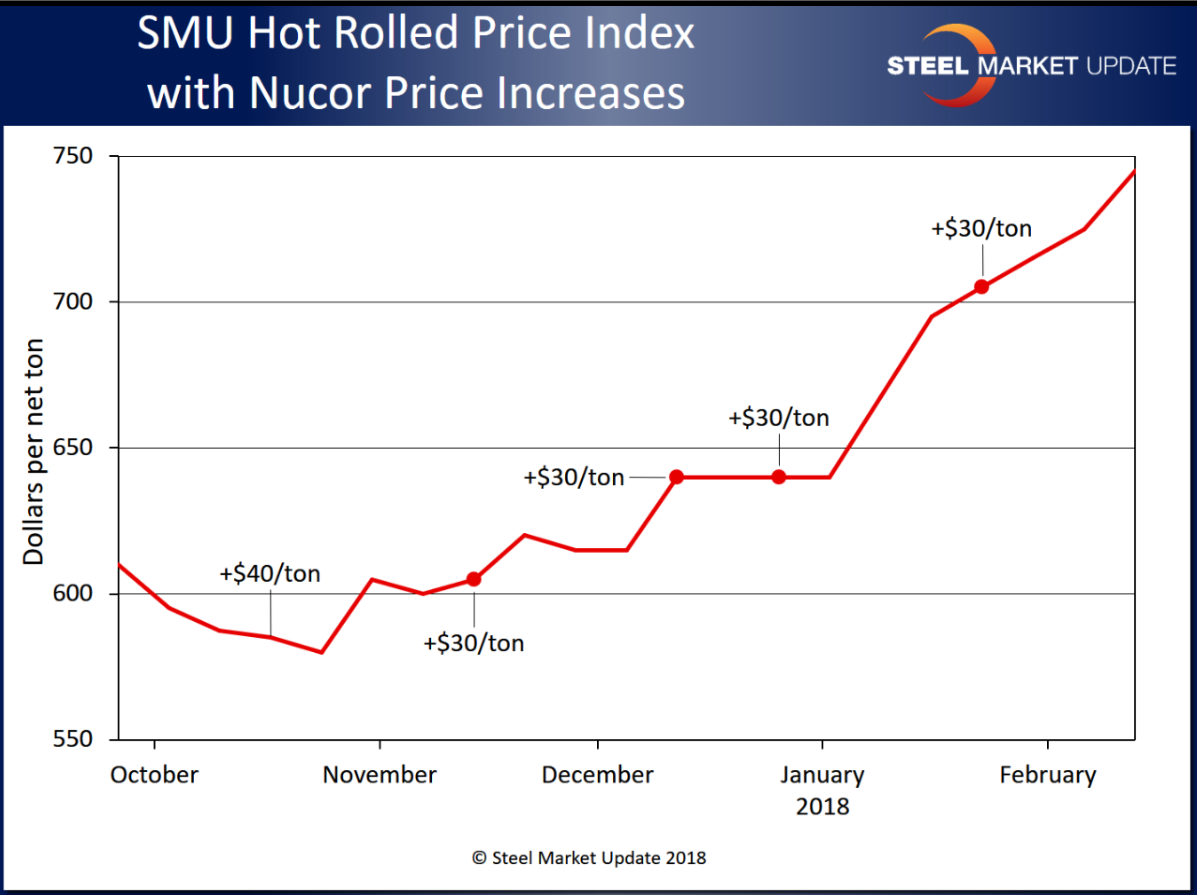

The current “up” cycle on sheet (HR, CR, galvanized and Galvalume) began nearly four months ago. According to the Steel Market Update hot rolled index, HRC prices bottomed in mid-October 2017 at $580 per ton ($29.00/cwt) FOB domestic steel mills east of the Rocky Mountains.

The first Nucor price increase in the cycle was a $30 per ton increase announced Nov. 15. Since then there have been three more price announcements totaling another $90 per ton ($120 per ton total). The SMU hot rolled average has increased to $745 per ton ($37.25/cwt) as of the week of Feb. 13, 2018. This is very close to the ArcelorMittal USA minimum base price guidance of $750 per ton provided in their last increase announcement.

We expect flat rolled prices will be increased very soon. We are already hearing from buyers of steel mills taking prices up prior to making any new announcements. The question is by how much. Since hot rolled is already reaching the numbers guided by AMUSA, and the fact that a plate price increase was just announced at $50 per ton, steel buyers should expect a $40 to $60 per ton increase, in SMU’s opinion.

The last time hot rolled coil prices reached an average of $745 per ton was in mid-January 2012 (that was the peak price in that cycle, and prices fell over the next six months to $600 per ton).

How high can prices go? The SMU HRC steel index hit $890 per ton in late March 2011…

For more historical price information please go to our website, login and click on the prices tab. If you have not used our interactive pricing graph on the website and you would like help, there is a video tutorial on the right side of the steel prices page. If you still need help, contact Brett@SteelMarketUpdate.com.

If you are not yet a Steel Market Update subscriber please ask us about rates for our Executive and Premium levels and what you need to do to join (or receive a new free trial). Contact us at info@SteelMarketUpdate.com or contact Brett at 706-216-2140.