Prices

February 25, 2018

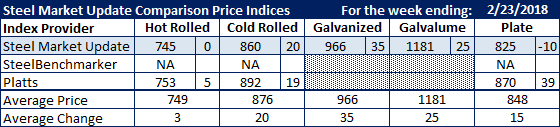

Comparison Price Indices: Mixed Results, But Big Week Anticipated

Written by John Packard

We saw mixed results depending on which index you are following. SMU believes the variance is due to quotes vs. actual orders and the fact that many buyers who are reporting prices may not have actually bought flat rolled steel products in the spot market (from mills) over the past week.

We are well aware that ArcelorMittal USA, U.S. Steel and perhaps others are quoting $800 per ton ($40.00/cwt) hot rolled coil. Nucor is reported to be at $790 per ton ($39.50/cwt) on HRC.

SMU’s average is $745 per ton, and we are expecting prices to continue to rise on HRC. Platts took their HRC up to $753 per ton by late in the week. SteelBenchmarker did not report prices this past week.

Cold rolled prices rose on both Platts and SMU indexes with our average reaching $860 per ton ($43.00/cwt), while Platts took their number to $892 per ton by the end of the week ($44.60/cwt). As with HRC, we expect CRC prices to rise again this coming week.

Galvanized .060” G90 increased by $35 per ton on the SMU index and is now averaging $966 per ton (including extras).

Galvalume rose by $25 per ton last week on our benchmark .0142” AZ50, Grade 80, which now averages $1,181 per ton.

Plate prices saw a disconnect as SMU numbers dropped by $10 per ton to $825 per ton, while Platts reported the single greatest one-day increase on Friday as their average jumped to $870 per ton ($869.75).

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.