Market Data

March 22, 2018

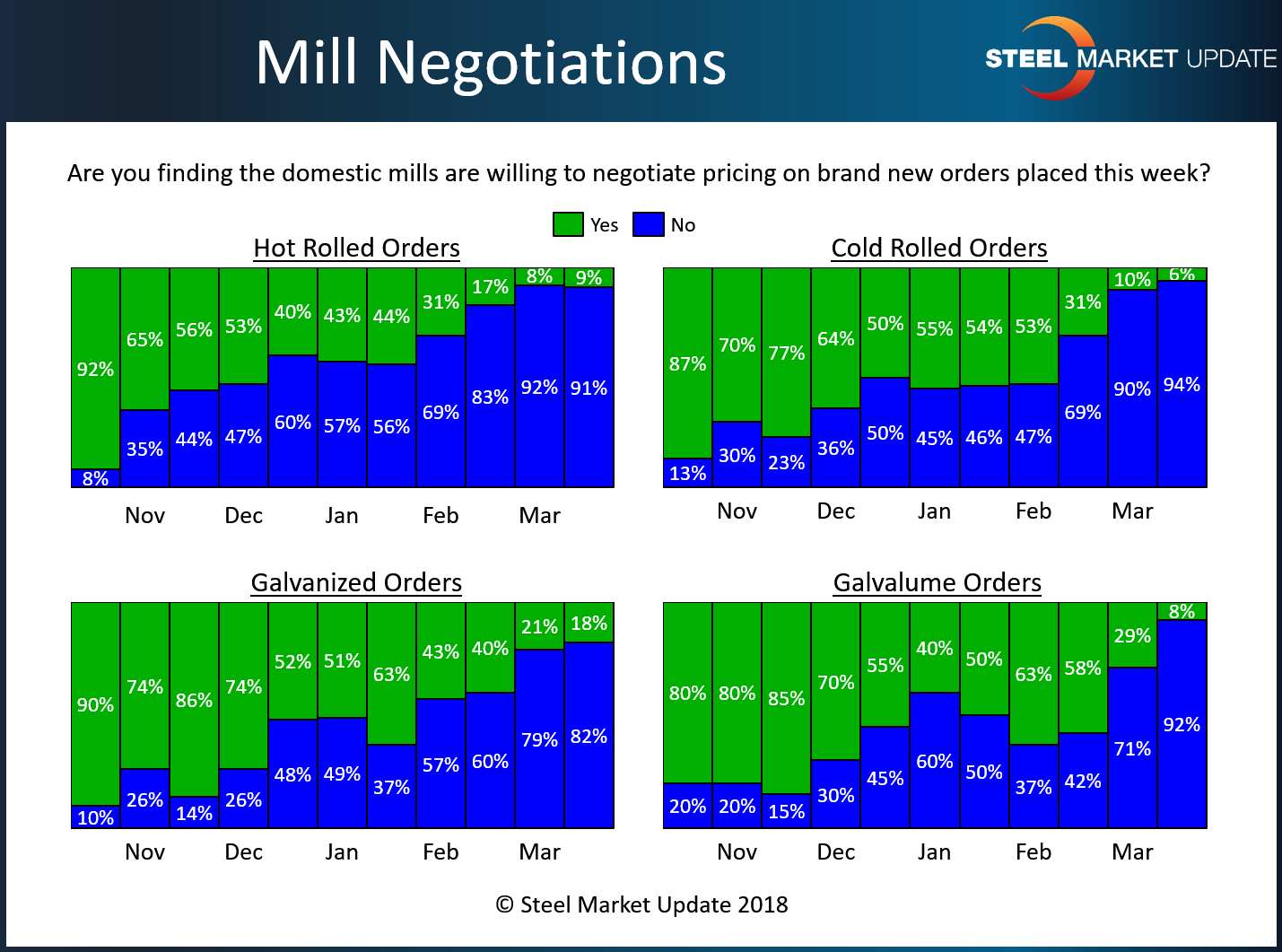

Steel Mill Negotiations: Mills Stand Firm

Written by Tim Triplett

With President Trump’s steel tariff set to kick in on Friday, domestic steelmakers remain in a strong pricing position. Buyers responding to this week’s SMU market trends questionnaire reported most mills unwilling to bend much when it comes to steel product prices, except in some cases for large orders.

By market segment, 91 percent of SMU respondents said the mills are holding firm on hot rolled steel prices, while only 9 percent have found mills willing to negotiate—about the same as two weeks ago.

In the cold rolled segment, only 6 percent said they have found some mills willing to talk price, while the vast majority (94 percent) reported mill prices on cold rolled as non-negotiable.

In the galvanized sector, about 82 percent of respondents said the mills are now standing firm on galvanized prices, while 18 percent said some mills are still open to negotiation on coated products. That’s more than a 20-point shift from just one month ago when 60 percent said mills were holding the line.

Negotiations also have tightened further for Galvalume. Two weeks ago, 71 percent of buyers reported that mills were not open to price discussions. Today, 92 percent said mills are unwilling to compromise on Galvalume prices.

Buyers tell SMU that only a few mills are flexible on price, and then only on large tonnages. Said one: “I have not tried to negotiate at these price levels. I avoid buying if possible as my cheaper tons from Q4 should keep me going for a few months.”

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.