Prices

April 17, 2018

SMU Price Ranges & Indices: Another Quiet Week

Written by John Packard

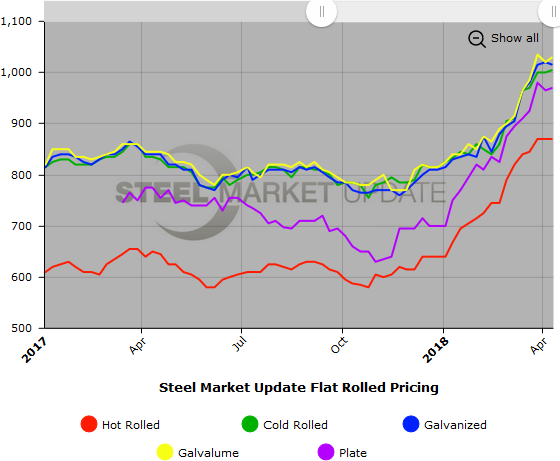

Flat rolled steel prices appear to have reached a plateau, at least on a temporary basis, according to steel buyers who reported mill spot pricing to Steel Market Update this week. Don’t let our headline fool you or lull you into complacency–steel mills are firm with their steel price offers and there has been very little evidence of an ongoing correction in prices. However, steel buyers think one is coming and many are waiting to see what will happen come May 1 when the tariff exclusions on Europe and a number of other steel-producing countries are due to expire.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $840-$920 per ton ($42.00/cwt-$46.00/cwt) with an average of $880 per ton ($44.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end rose $20 per ton. Our overall average is up $10 compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 4-9 weeks

Cold Rolled Coil: SMU price range is $990-$1,020 per ton ($49.50/cwt-$51.00/cwt) with an average of $1,005 per ton ($50.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU base price range is $49.00/cwt-$52.00/cwt ($980-$1,040 per ton) with an average of $50.50/cwt ($1,010 per ton) FOB mill, east of the Rockies. The lower end of our range fell $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $5 compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,066-$1,126 per net ton with an average of $1,096 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-12 weeks

Galvalume Coil: SMU base price range is $50.00/cwt-$52.00/cwt ($1,000-$1,040 per ton) with an average of $51.00/cwt ($1,020 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end declined $20 per ton. Our overall average is down $10 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,291-$1,331 per net ton with an average of $1,311 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-12 weeks

Plate: SMU price range is $940-$1,020 per ton ($47.00/cwt-$51.00/cwt) with an average of $980 per ton ($49.00/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $10 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: “Allocation” 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.