Market Data

May 17, 2018

Steel Mill Lead Times: Signs of Shortening?

Written by Tim Triplett

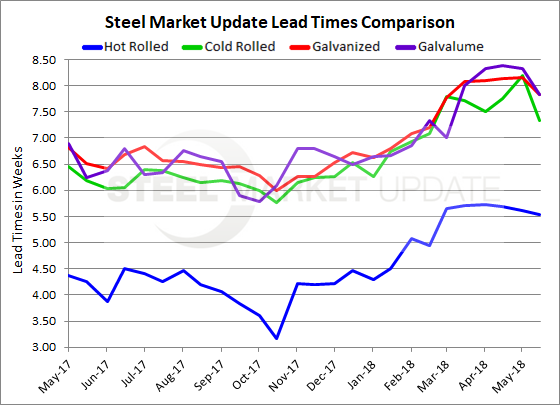

Mill lead times, which had been stretching for much of the year, may have turned the corner. Flat rolled lead times are still extended, but appear to be stabilizing, according to Steel Market Update’s latest market trends data. Lead times for hot rolled now average about five and a half weeks, cold rolled about seven and a half weeks, and galvanized and Galvalume less than eight weeks.

Hot rolled lead times now average 5.54 weeks based on the responses from this week’s flat rolled steel market trends questionnaire. Lead times on hot rolled peaked in early April at 5.73 weeks and have been slowly shortening ever since. They are still extended compared with a year ago, however, when HRC lead times averaged 4.26 weeks.

Cold rolled lead times have also come down to 7.34 weeks on average from 8.19 weeks in early May. Last year at this time, CR lead time was 6.19 weeks.

Like CR, galvanized lead times have shortened over the past month from just over 8 weeks to just under at 7.82 weeks, on average. One year ago, the lead time on CR was 6.51 weeks.

Galvalume lead times have also declined to 7.83 weeks from 8.38 weeks one month ago. One year ago, AZ lead times were at 6.25 weeks.

Lead times for steel delivery are a measure of demand at the mill level. The more extended the lead time, the busier the mills.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.