Analysis

June 2, 2018

Truck Popularity Keeps Auto Sales Moving

Written by Sandy Williams

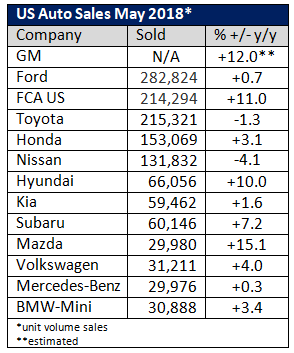

Rising fuel prices don’t seem to be impacting automotive sales; U.S. consumers are still hungry for SUVs and light trucks. WardsAuto reported that U.S. automakers delivered 1.58 million light vehicles in May for a seasonally adjusted annual rate of 16.8 million units.

FCA U.S. reported sales of 214,294 vehicles, up 11 percent from a year ago, boosted by a 29 percent jump in Jeep sales. Although rumors circulated that FCA was about to dump the Chrysler brand, no such announcement was made by Sergio Marchionne in his last presentation as CEO. Notably, no specific presentations were given for the Chrysler, Fiat or Dodge brands.

Marchionne says the company will invest about $10.5 billion in gas/electric hybrids and fully-electric vehicles in the next five years. Diesel engines will be phased out and all new models will offer some form of electrification by 2022.

In North America, FCA plans to expand its Jeep portfolio, as well as offering electrified options for all of its Jeep vehicles.

Although General Motors is no longer reporting monthly sales, analysts estimate its sales increased about 12 percent last month.

Toyota sales were down 1.3 percent and Nissan’s were down 4.1 percent. Honda sales rose 3.1 percent on SUV and truck sales to 153,069 vehicles.

Volkswagen Group sales increased 4.0 percent to 31,211 units in May. In separate news, the company expressed its “regret and concern” over the implementation of steel and aluminum tariffs on the European Union.

“We fear that this could mark the start of a negative development of measures and countermeasures from which no one will emerge as the winner,” the German automaker said in a statement.