Market Segment

October 28, 2018

Reliance Posts Second Best Quarterly Sales

Written by Sandy Williams

Reliance Steel & Aluminum reported its second highest quarterly net sales in the company’s history. Third-quarter net sales jumped 21.4 percent year-over-year to $2.97 billion, down just 0.5 percent from the record set in the second quarter at $2.99 billion.

Reliance net income for the quarter of $148.2 million was impacted by a $36.8 million tax impairment and restructuring charge. As a result, income was down 35.7 percent from the prior quarter. Earnings per diluted share fell 35.8 percent from the second quarter to $2.03 per share.

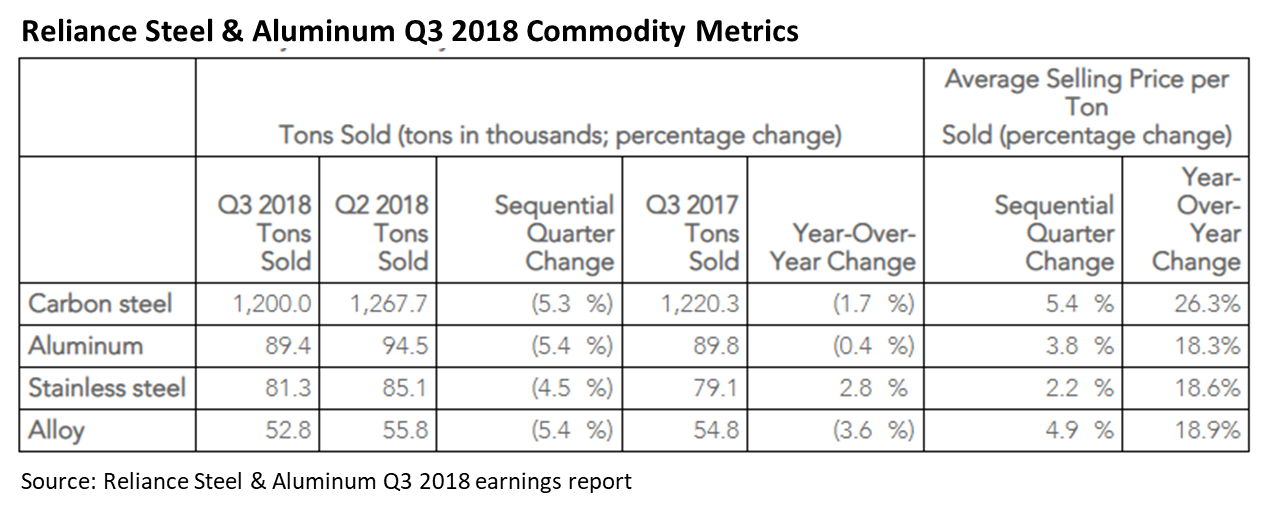

Total tons sold declined 5.3 percent from the second quarter to 1,504,100 tons due to normal seasonality. Average selling price was $1,972 per ton.

Reliance executives noted strong demand in aerospace and automotive during the third-quarter conference call. Non-residential construction continues to improve along with heavy industry demand. The energy market recovery is continuing, indicated by increased rig counts and drilling activity and longer mill lead times for energy-related products.

Reliance executives noted strong demand in aerospace and automotive during the third-quarter conference call. Non-residential construction continues to improve along with heavy industry demand. The energy market recovery is continuing, indicated by increased rig counts and drilling activity and longer mill lead times for energy-related products.

Reliance expects fourth-quarter demand, while healthy, to be affected by normal seasonal patterns. As a result, tons sold are expected to decrease 5-7 percent compared to prior quarter. Pricing fundamentals are expected to remain steady to slightly up based on current demand levels, raw material costs and ongoing trade actions. Reliance anticipates its average selling price in the fourth quarter to be flat to up 1 percent.

During the quarter, Reliance completed the acquisition of KMS Fab and KMS South, which specialize in sheet metal fabrications. In addition, Reliance announced last week that it had acquired the remaining 40 percent ownership interest in Acero Prime, a toll processor in Mexico, from U.S. Steel.

Commenting on the auto industry, Reliance COO Jim Hoffman said he doesn’t expect the company to lose volumes on the steel side because of increases in aluminum use. “We don’t anticipate that. There’s still going to be a lot of steel in cars. The steel folks are working really hard to come up with new higher-strength steels that they can use to meet the lightweighting regulations that are out there.”

CFO Karla Lewis added, “Aluminum is a little more difficult to process and handle than the carbon, so our pricing is a little stronger for the aluminum that we’re processing compared to the carbon. So, we’re comfortable with supporting that shift, but there’s continued growth in both.”