Prices

February 5, 2019

CRU: Iron Ore Prices Rise Sharply on Vale’s Production Cuts

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

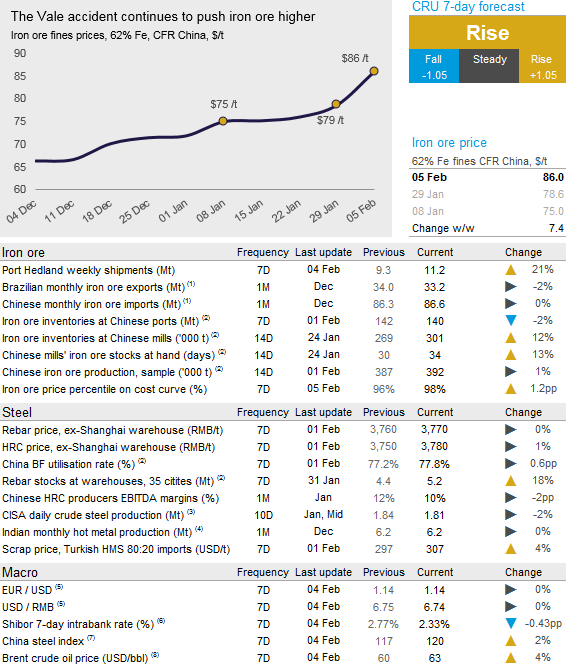

Iron ore prices continued to climb during the week as uncertainty regarding Vale’s supply persists. With weak buying in China due to the holidays, we have seen the market react by pushing the 62% Fe fines price up to $86.00 /t, $7.40 higher w/w.

The Vale story continues to dominate the news and a temporary suspension of production at various mines in Vale’s Southern System will result in ~40 Mt/y of lost production, including 11 Mt/y of pellet from the two suspended pellet plants Vargem Grande and Fabrica. On Monday, news surfaced regarding further suspension of production. The Brucutu mine, with ~30 Mt/y of production, has been ordered to shut its production line by authorities. The mine is part of Vale’s Southeastern System and the first suspended mine outside of Vale’s Southern System. Our understanding is that the Brucutu mine is a key pellet feed supplier to Vale’s newest pellet plant, Tubarao VIII.

Australian supply has improved considerably in the past week. FMG’s shipments have improved after a weak start to the year and the company has in the past week exported at an annualized rate of ~200 Mt/y.

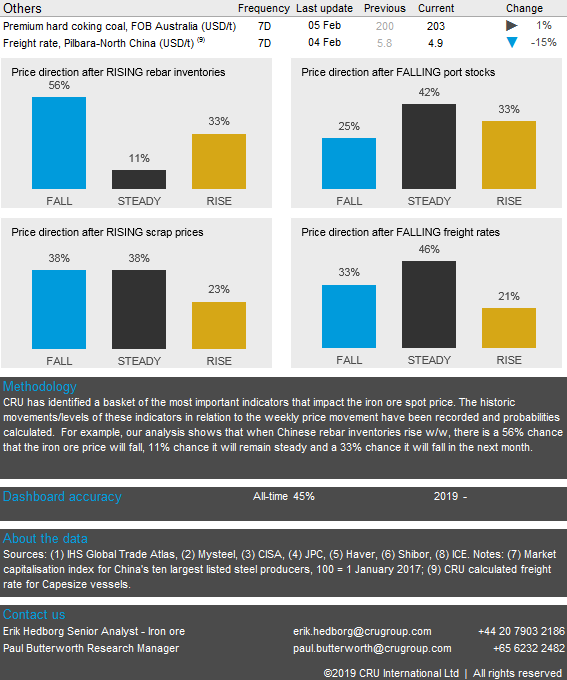

The demand side in China is expected to remain quiet in the next week. The supply uncertainty continues and will dictate the iron ore price direction in the coming weeks. Our indicators below suggest there is room for the price to correct somewhat, but any news on Vale’s production can generate large price swings in either direction. We see a risk for further output suspensions and therefore expect prices to be higher one week from now.

Editor’s note: The Jan. 25 collapse of a tailings dam at Vale’s Corrego do Feijao mine in southeastern Brazil caused extensive flood damage and loss of life, disrupting the global iron ore market.