Market Data

April 28, 2019

Service Centers No Longer Supporting Higher Spot Prices

Written by John Packard

Twice per month Steel Market Update conducts an analysis of the flat rolled and plate steel markets and market trends. We are searching for what is moving the markets, and what buyers and sellers of steel should anticipate in the coming weeks and months. One of the key questions associated with our analysis: Are the service centers supporting (or not) higher spot pricing to their end user customers? What SMU has found over time is when steel distributors are raising spot prices, they are at the same time supporting higher mill pricing. When service centers are dumping inventory into the markets, they are de facto no longer supporting higher mill prices.

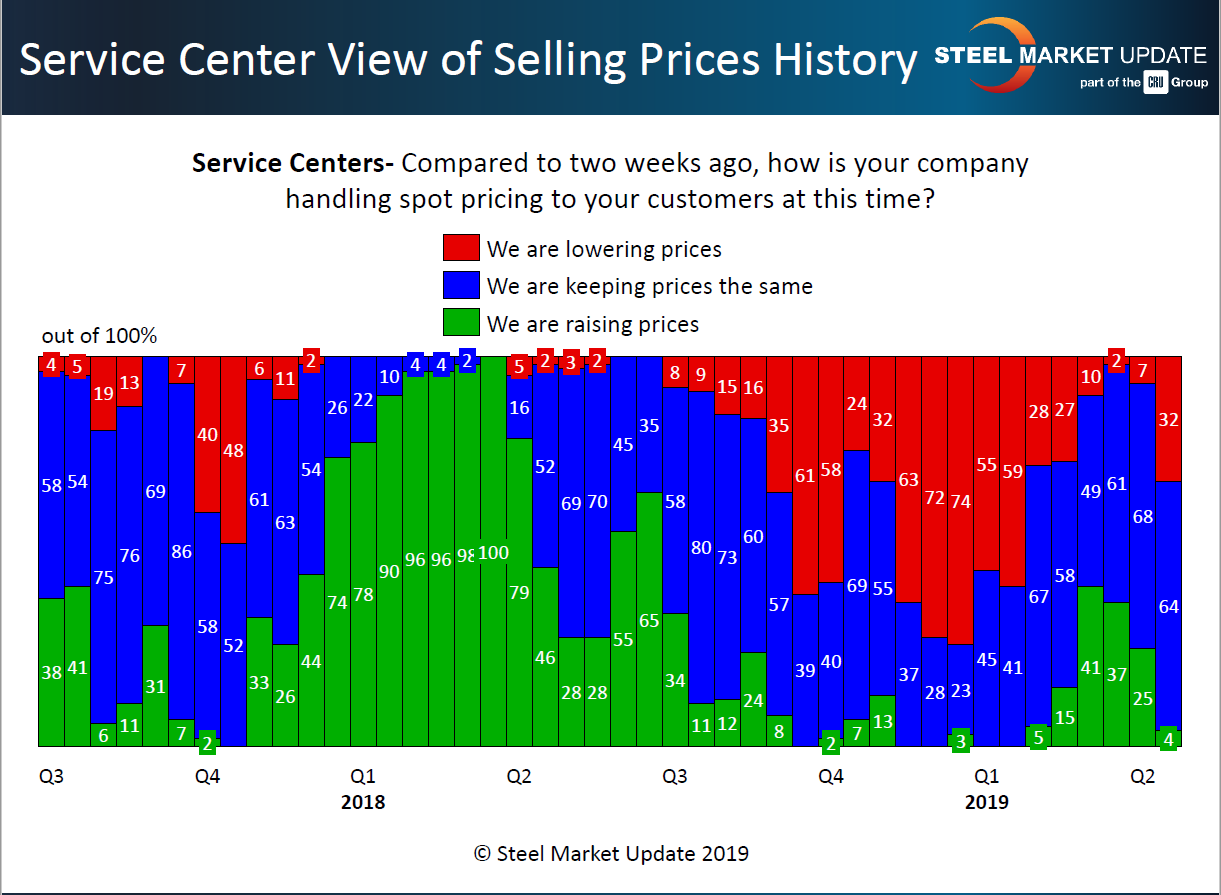

The results of last week’s analysis are in and we are finding, and manufacturing companies are confirming, that service centers are dropping their spot prices and no longer actively supporting higher steel prices. As you can see in the graphic below, 32 percent of the distributors are now reporting their company as lowering spot pricing to their customers. This is up from just 7 percent reported at the beginning of the month of April 2019.

At the same time the green bars, which represent rising spot prices, dwindled from 25 percent at the beginning of the month to 4 percent now.

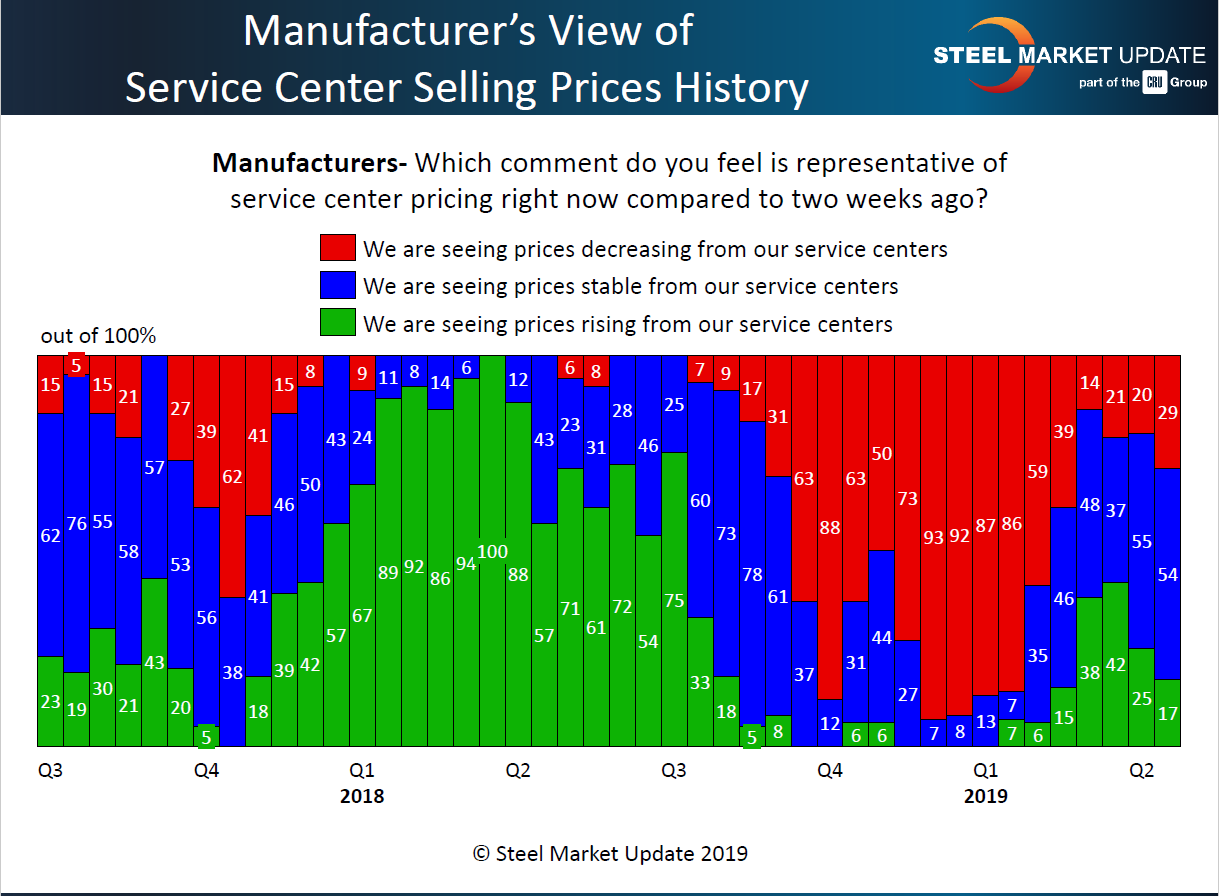

Manufacturing companies concur with what the service centers reported, as 29 percent of the manufacturing companies are now seeing lower pricing out of the steel distribution suppliers. This is up 9 percentage points from the beginning of the month of April. A smaller percentage of manufacturing companies (17 percent vs. 25 percent earlier this month) reported distributors as trying to raise spot prices.