Product

June 6, 2019

SMU Steel Buyers Sentiment Index: Attitudes Suffering

Written by Tim Triplett

Industry sentiment has continued to erode this month as the attitudes of steel executives appear to be suffering from the relentless uncertainty over steel pricing, demand and Trump administration trade policies.

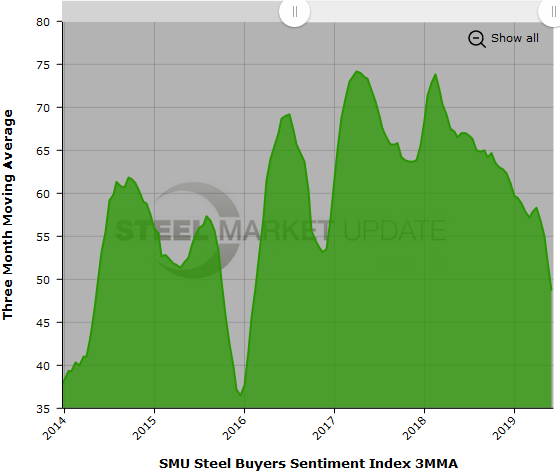

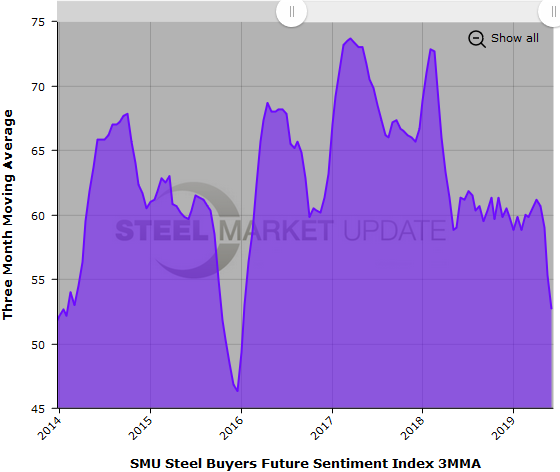

The goal of the index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

Current Sentiment measured as a single data point registered +35 in the latest data, down 7 points in the past two weeks and less than half the peak of +78 in January 2018. Current Sentiment has not been this low in three and a half years.

Measured as a 3MMA, Current Sentiment averaged 48.67, down more than 4 points from the reading in mid-May. The last time the Current 3MMA was this low was February 2016. The 3MMA for Current Sentiment peaked at 74.17 in April 2017.

Future Sentiment

Respondents were asked to assess their chances for success in three to six months. Measured as a single data point, Future Sentiment registered +42, down 1 point over the last two weeks, but down 7 points in the past month and at its lowest level since October 2015. Future Sentiment peaked at +77 in February 2017.

Measured as a 3MMA, the Future Sentiment Index averaged 52.67, down another 3 points in the past two weeks and at its lowest point since January 2016. Future 3MMA peaked at 73.67 in March 2017.

Note that any figure above zero falls on the optimistic half of SMU’s scale. Therefore, industry sentiment remains positive, though considerably less so than last year. At its lowest point in the depths of the Great Recession, Current Sentiment sunk as far as -85.

What Our Respondents Had to Say

“Demand is off over 10 percent.”

“The market is just BLAH.”

“Margins, pricing and inventories are out of sync.”

“It’s becoming next to impossible to import tariff material.

“Traditional trading partners cannot predict the sudden and poorly founded tariffs and trade action of the current U.S. government. I don’t have confidence we can do well in this protectionist business climate.”

“Business conditions in today’s plate market get worse by the day. Nobody has any confidence that things will improve anytime soon.”

“There’s too much uncertainty short and long term.”

“We need steel prices to stop sliding.”

“With this much uncertainty, there’s no clear and positive future.”

“We see more headwinds than tailwinds.”

“This needs to turn around quickly to salvage 2019 on the back half.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 45 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

{loadposition reserved_message}