Prices

June 9, 2019

CRU: Iron Ore Falls Back Below $100/t in a Volatile Market

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

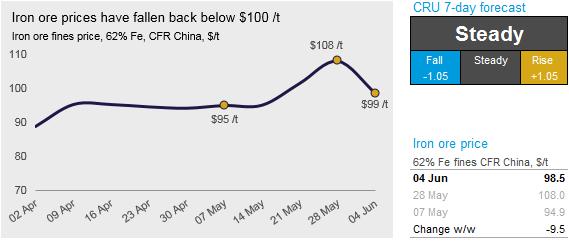

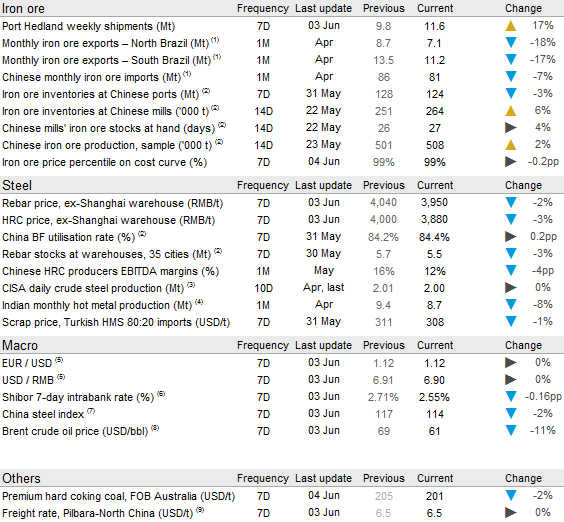

Iron ore prices went through a correction in the past week as Chinese steel prices kept falling and seaborne supply remained robust. On Tuesday, June 4, CRU assessed the 62% Fe fines price at $98.50 /t, a $9.50 /t fall w/w.

Our sources see the price fall as a market correction after the futures market pushed prices up to $108 /t last week on the potential of trade wars resulting in further Chinese stimulus. In the past week, signs of weakness on the demand side have emerged as steel prices have continued their downward trend and steelmakers have reported increased inventories of finished steel products. Steelmakers have also seen their margins getting squeezed in recent weeks as both HRC and rebar producers are now making margins in the 0–5 percent range.

Seaborne supply has improved considerably. Shipments from Para (Vale’s Northern System) have recovered to levels seen before the heavy rainfall in March-May and Rio Tinto is now shipping at full rate. Our tracking of Port Hedland shipments have in the past week registered the second highest level in the past year as all major producers have been shipping above nominal capacity.

The key event that has caught attention in the past week is the collapse of the mine wall at Vale’s Gongo Soco mine in Minas Gerais. There have been fears that a sudden wall collapse would generate seismic movements that would cause the Sul Superior dam, located 1.5 km away, to breach. On Friday, the first fragments of the wall fell into the mine pit without causing any major impact. Since then, the wall has slowly disintegrated into the mine pit, which means the risk of a breach at the Sul Superior dam is diminishing. Sul Superior is an upstream dam containing 6 million m3 of tailings, which makes it smaller than the two upstream dams that have collapsed in the past four years – Vale’s Feijão dam (12 million m3) and Samarco’s Fundão dam (55 million m3).

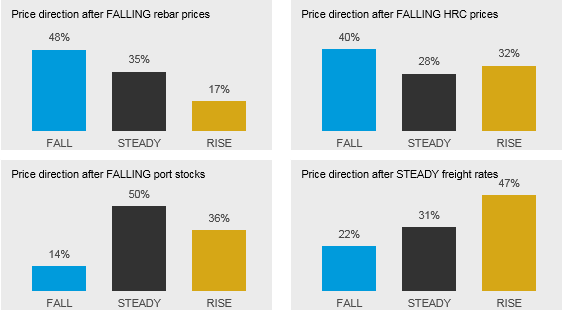

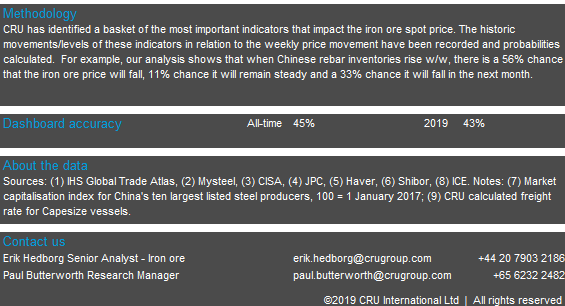

Our indicators below give mixed signals for the price direction in the coming week. Strong supply and continued weakness in the Chinese steel industry will limit the upside to iron ore prices. However, the low inventories at ports and mills will reduce the downside risk for prices. Therefore, we expect prices to remain STEADY in the coming week.