Market Data

July 31, 2019

Global Manufacturing Off to a Weak Start in Q3

Written by Sandy Williams

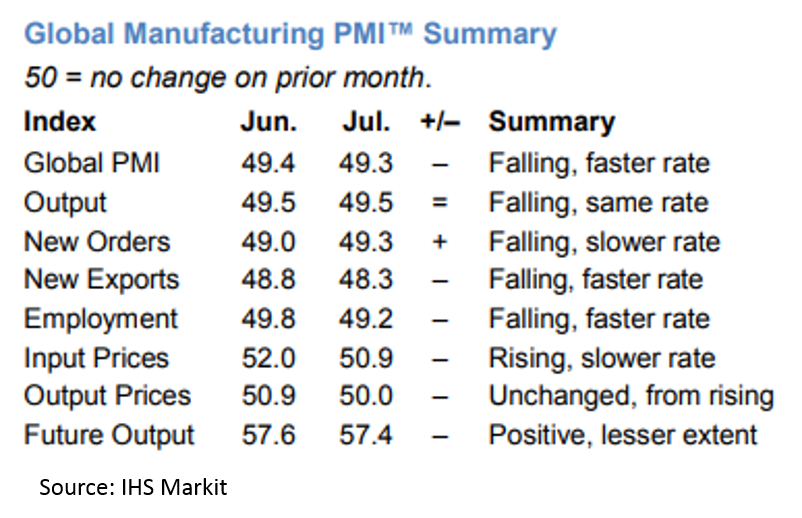

Manufacturing conditions continued to deteriorate around the globe in July as trade disputes and tension took a toll on national economies. The J.P. Morgan Global Manufacturing PMI registered 49.3 in July, slipping slightly from 49.4 in June and remaining in contraction for a third month.

Nineteen of 30 nations surveyed in July signaled downturns, said J.P. Morgan and IHS Markit. China, Japan, South Korea, Taiwan, the EU, the UK, and Brazil were among those with PMIs in contraction. The U.S. and Canada were spared only slightly with respective PMI levels of 50.4 and 50.2.

Export decline was widespread as were reductions in employment, input purchasing and inventories.

Commenting on the survey, Olya Borichevska, from Global Economic Research at J.P. Morgan, said: “July PMI data signal that the global manufacturing sector remained on a weak footing at the start of the third quarter. The PMI implies no growth in global manufacturing output with the deteriorating trend in international trade flows weighing particularly heavily on performance. Market conditions will need to stage a solid recovery if the growth outlook is to improve during the coming months. However, firms are not expecting this with future output PMI continuing to trend lower through July.”

Deteriorating manufacturing conditions in the European Union kept the IHS Markit Manufacturing PMI in contraction at 46.5 in July. The PMI has been below the neutral mark of 50 for six straight months. Order books declined sharply, cutting production output at the fastest rate since April 2013. Purchasing activity dropped at its fastest monthly rate in six years as firms utilized existing inventory for production. Excess supply of some raw materials caused input costs to decline and, when coupled with weak demand and excess capacity, led firms to lower prices for the first time in almost three years. Backlogs fell for the 11th successive month taking employment levels with them.

“The Eurozone PMI dashboard is a sea of red, with all lights warning on the deteriorating health of the region’s manufacturers,” said Chris Williamson, chief business economist at IHS Markit.

Germany is leading the downturn as the auto market falters and demand for business equipment declines. Deterioration of manufacturing conditions is widespread across the region except in Greece.

“Rising geopolitical concerns, including trade wars and Brexit, and worries about slower economic growth both domestically and internationally, were all reported as having subdued current demand and hit confidence in the outlook,” said Williamson.

Manufacturers in China are experiencing relatively stable conditions as the third quarter begins. The Caixin China General Manufacturing PMI registered 49.9 in July, just below the growth market for the index and up from June’s reading of 49.4. Stronger domestic demand contributed to a slight increase in new orders. The trade dispute with the U.S. continued to mute export orders.

“China’s manufacturing economy showed signs of recovery in July. Business confidence rebounded, reflecting the strong resilience in the economy,” commented Dr. Zhengsheng Zhong, director of Macroeconomic Analysis at CEBM Group.

The PMI for Russia remained in contraction in July, posting 49.3, up from 48.6 in June. Demand fell both home and abroad with new export orders declining at the fastest pace in five months. Production and new orders both declined, although employment levels rose fractionally during the month. Inventory reduction resulted in a slight increase in input buying to replenish stocks. Inflationary costs softened and firms relied on discounting to encourage sales. Business confidence fell regarding future output.

The Canada PMI rose from contraction last month posting a reading of 50.2 from June’s reading of 49.2. Rising pre-production inventories and slower declines in production levels helped to firm conditions in the sector. Business optimism for the year rose and firms increased hiring for the third month. Manufacturing output and sales declined in July, but at a much slower rate. Declines in order books were attributed to subdued export demand that was blamed on softer economic growth in the U.S. and Europe. Global trade tension was also cited as a headwind, said IHS Markit. A sharp reduction in backlogs was noted and a lack of pressure on capacity.

“July data provides some encouragement that the downturn in Canadian manufacturing production has started to lose intensity, with the latest survey pointing to the slowest drop in output for four months,” commented Tim Moore, Economics associate director at IHS Markit. “External demand conditions remain the main concern for the manufacturing sector, as highlighted by an accelerated reduction in new export orders in July. There were widespread reports that global trade frictions and softer economic growth in key markets had held back export sales.”

Manufacturing conditions remained in contraction in Mexico as demand declined domestically and abroad. Production and sales fell for the second month in a row. New hiring was offset by layoffs at some firms. The PMI rose to 49.8 from 49.2 in June.

“Lower sales in the past two months translated into an unplanned rise in stocks of finished goods during July, one that was solid and the most pronounced since last November. As a consequence, companies reduced production for the second month running and may restrict output further in the near-term until stocks are used up,” said Pollyanna De Lima, Principal Economist at IHS Markit “Also boding ill for the outlook was a substantial dip in business confidence. We saw optimism fade in July to its weakest since expectations data were first compiled in early 2012. Firms were highly concerned about the prospects of an economic recession, unstable market conditions, weak client demand and an uncertain outlook.”

The IHS Markit U.S. Manufacturing PMI fell to its lowest level since September 2009 as demand remained subdued and production grew only marginally. The PMI posted at 50.4 in July, just above the no growth mark of 50 and a slight decline from 50.6 in June. “Output expectations slipped further to a series low (since July 2012) as business conditions are predicted to remain challenging over the coming 12 months, especially for smaller firms,” said IHS Markit.

“U.S. manufacturing has entered into its sharpest downturn since 2009, suggesting the goods-producing sector is on course to act as a significant drag on the economy in the third quarter,” commented Williamson. “The deterioration in the survey’s output index is indicative of manufacturing production declining at an annualized rate in excess of 3 percent. Falling business spending at home and declining exports are the main drivers of the downturn, with firms also cutting back on input buying as the outlook grows gloomier. U.S. manufacturers’ expectation of output in the year ahead has sunk to its lowest since comparable data were first available in 2012, with worries focused on the detrimental impact of escalating trade wars, fears of slower economic growth and rising geopolitical worries.”