Market Data

August 1, 2019

Service Center Spot Pricing: Big Upturn in Momentum

Written by John Packard

Price momentum has shifted dramatically in the steel spot market since mid-June following three price increase announcements by the major mills. Both service centers and their customers report rising prices in today’s marketplace.

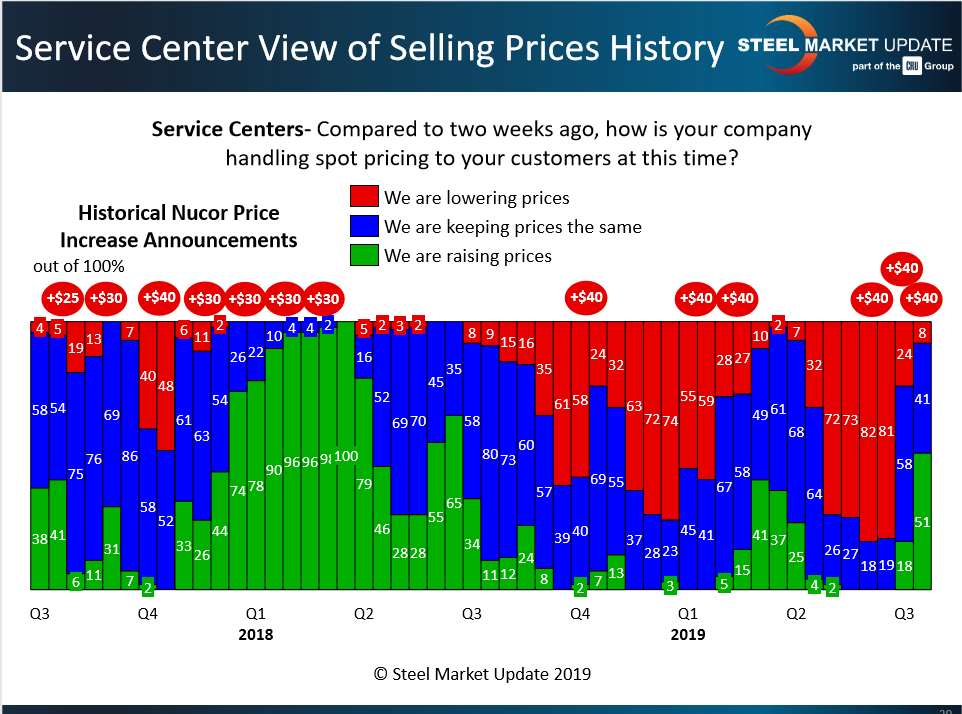

As seen in the chart below, 81 percent of the service centers polled by Steel Market Update just six weeks ago said they were lowering prices to customers. Last week, only 8 percent said they were offering lower prices, while the majority, 51 percent, said they are raising prices.

Steelmakers have announced three $40-per-ton increases on flat rolled products since late June, plus a $40 hike in plate prices in the past few days, and appear to have reversed the year-long downtrend in the price of steel—though how much and for how long is still to be determined. Much depends on the level of support the increases receive from the service centers. The chart clearly shows that service centers reached what SMU calls the “point of capitulation” in June. Historically, when the number of service centers lowering prices reaches 75 percent, that signals a tipping point at which distributors “give in” to the need to raise prices and preserve the value of their inventories versus further discounting to secure orders.

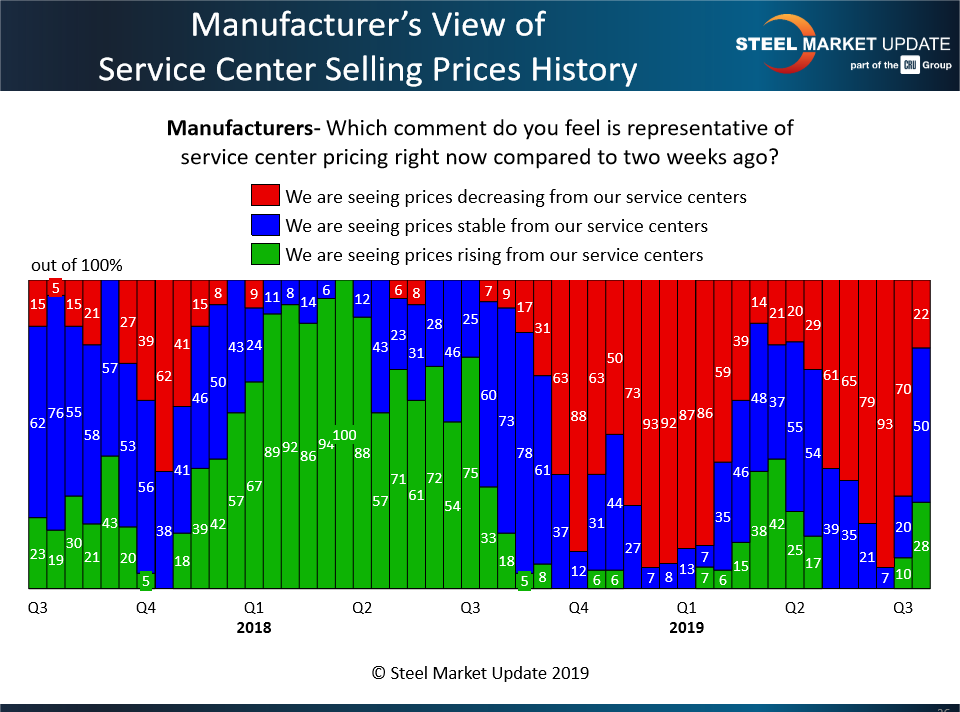

Corroborating the trend, just 22 percent of the manufacturers responding to SMU’s latest market trends questionnaire said they are still seeing lower prices from their service center suppliers. That’s down from nearly all (93 percent) who reported declining service center prices in June. Twenty-eight percent said they are now seeing higher prices from service centers. The biggest group, half of the manufacturers, characterize service center prices as stable, neither increasing nor decreasing.

Obviously, there’s a bit of a disconnect between the largest respondent groups in each category. Half the service centers say they are raising prices, while half their customers say prices have leveled off. It’s unlikely both could be true. That suggests the service centers may not be collecting all the increases they are seeking—and may speak to the staying power of the upward price momentum.