Prices

August 20, 2019

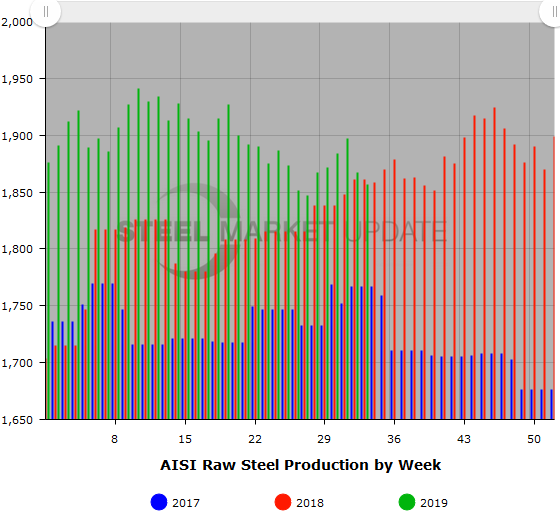

Steel Mill Utilization Dips Below 80 Percent

Written by Tim Triplett

Steel mill capacity utilization dipped below the 80 percent mark last week for the first time since early July, registering 79.8 percent, reported the American Iron and Steel Institute. Production was down by 0.2 percent compared with the same period last year–the first time this year that weekly production was below 2018 levels. Raw steel production for the week ending Aug. 17 totaled 1,857,000 net tons, a decrease of 0.5 percent from the previous week when the U.S. mill utilization rate averaged 80.2 percent.

Domestic steelmakers have produced 61,669,000 tons for the year to date, a 4.5 percent increase compared with the same period in 2018. Mill utilization has averaged 81.0 percent so far this year, up from 77.3 percent last year.

Following is production by district for the Aug. 17 week: North East: 205,000 net tons; Great Lakes, 686,000 net tons; Midwest, 190,000 net tons; South, 702,000 net tons; and West, 74,000 net tons, for a total of 1,857,000 tons. Production for the week decreased in all regions except for a small uptick in the North East and West.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.

Note: Capability for third-quarter 2019 is approximately 30.6 million tons compared to 30.8 million tons for the same period last year and 30.3 million tons for second-quarter 2019.