Market Data

August 22, 2019

Steel Mill Lead Times: Mixed Message

Written by Tim Triplett

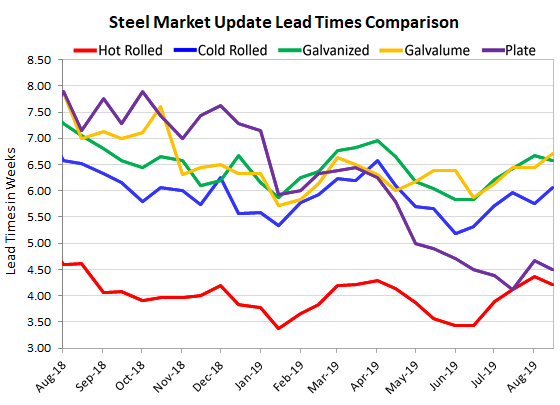

If the price increases announced by the mills over the past two months were gaining real traction, it should be showing up in lengthening mill lead times. According to Steel Market Update data, the impact on lead times has been mixed and minimal.

Lead times for steel delivery are a measure of demand at the mill level. The longer the lead time, the busier the order activity at the mills, and the less likely they are to discount prices. The average lead time for hot rolled is now a bit more than four weeks, cold rolled is about six weeks and coated steels are around six and a half weeks. Plate lead times are at four and a half weeks. All are shorter than at this time last year.

Hot rolled lead times now average 4.22 weeks, down from 4.36 weeks in early August. The average cold rolled lead time stretched slightly to 6.07 weeks, up from 5.75 weeks earlier in the month. The average lead time for galvanized dipped to 6.57 weeks from 6.67 in SMU’s early August canvass of the market. The current average lead time for spot orders of Galvalume is up slightly at 6.70 weeks.

Lead times for spot orders of plate steel have also declined slightly. Lead times for plate now average 4.50 weeks, down from 4.67 weeks earlier in August.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.