Overseas

August 27, 2019

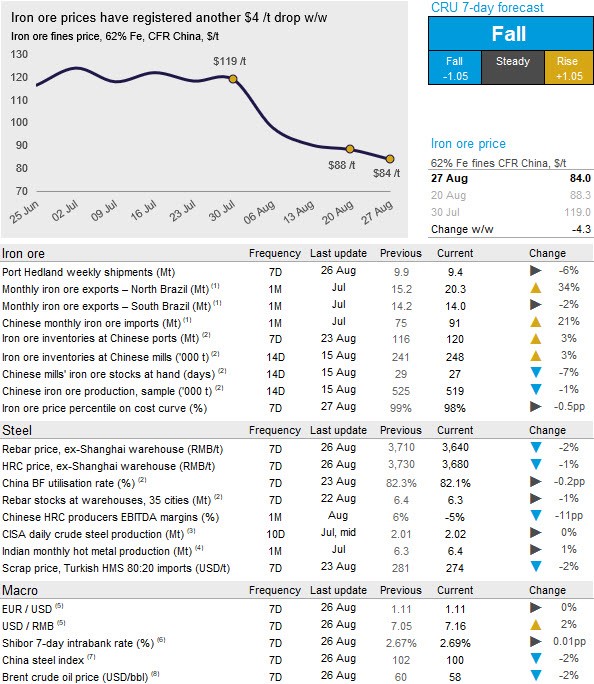

CRU: Iron Ore Price Fall Continues

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

Iron ore continued to fall in the past week as weakness in the Chinese steel market continued with steel prices declining further. Iron ore spot offers also rose over the last week. On Tuesday, Aug. 27, CRU has assessed the 62% Fe fines price at $84.00 /t, a $4.30 /t fall w/w.

As the trade war escalates, the demand outlook for steel in China is looking increasingly bleak. Besides the U.S. announcing further tariff hikes to Chinese goods, another important macro story has been the continued devaluation of the Chinese renminbi, which currently stands at 7.16 against the U.S. dollar, another RMB0.11 rise w/w. This is keeping demand for RMB denominated port stocks high, while the cost of seaborne cargoes is increasing.

Supply for iron ore has remained steady, although we see a temporary drop of Port Hedland shipments caused by lower supply by FMG. BHP’s shipments have remained strong in August and the company is on track to reach an annualized shipping rate of 300 Mt/y for the full month, one of the highest on record. Vale has in recent weeks offered a large number of Carajás cargoes on the spot market, which is in line with the record-strong supply from northern Brazil in July. CRU is hearing that shipments from India are likely to drop in the coming weeks. Falling low-grade prices is likely to result in withdrawals from the export market. In addition, the recently completed auction of stockpiles in Goa was a disappointment as only one-third of the ~5 Mt of stockpiles ended up being sold.

We are getting mixed signals from the market, and news on the trade war can shift the market rapidly in either direction. The steel market is still weak as prices continue to fall and any iron ore supply decreases are likely to take time, considering that prices are still at a relatively high level. We expect prices to continue to decline in the coming week.

.