Market Data

September 3, 2019

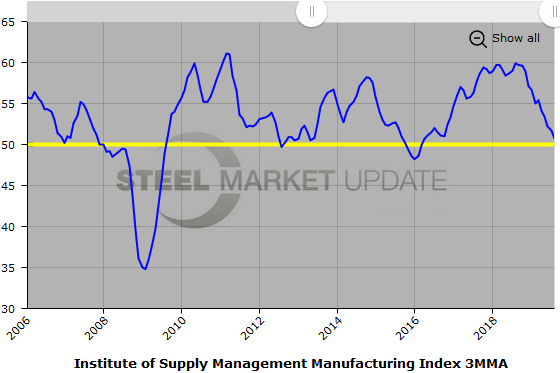

ISM PMI Slides Into Contraction

Written by Sandy Williams

The ISM Manufacturing Index fell to 49.1 percent in August from 51.2 percent in July indicating a contraction in business activity and the lowest level since the 48.0 percent reading in January 2016.

“Comments from the panel reflect a notable decrease in business confidence,” said Timothy R. Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee. “August saw the end of the PMI expansion that spanned 35 months, with steady expansion softening over the last four months. Demand contracted, with the New Orders Index contracting, the Customers’ Inventories Index recovering slightly from prior months and the Backlog of Orders Index contracting for the fourth straight month. The New Export Orders Index contracted strongly and experienced the biggest loss among the subindexes.”

Contractions in production and employment were also heavy contributors to the headline PMI.

“Respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Respondents continued to note supply chain adjustments as a result of moving manufacturing from China. Overall, sentiment this month declined and reached its lowest level in 2019,” said Fiore.

Only half of the 18 manufacturers surveyed in August reported growth. Seven industries reported contraction including fabricated metal products, transportation equipment and primary metals.

Survey commentary included:

- “Slightly lower rate of incoming orders may be seasonal or a sign of a general slowdown. Monitoring closely.” (Fabricated Metal Products)

- “Business is starting to show signs of a broad slowdown.” (Machinery)

- “Seeing some relief in the availability of electronic components in the marketplace, but there are still pockets of short supply, allocation, long lead times and the like. Tariffs continue to be a strain on the supply chain and the economy overall.” (Computer & Electronic Products)

- “While business is strong, there is an undercurrent of fear and alarm regarding the trade wars and a potential recession.” (Chemical Products)

- “Slowest month (July) this year so far in sales.” (Transportation Equipment)

- “Late planting of the corn and soybean crops has increased uncertainty over the final acres and yields. This is leading to volatile markets.” (Food, Beverage & Tobacco Products)

- “Generally, business remains steady. However, we continue to plan for a hard Brexit and a long trade war between the U.S. and China.” (Miscellaneous Manufacturing)

- “The market for large building structures is slowing.” (Nonmetallic Mineral Products)

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.