Prices

September 12, 2019

Cleveland-Cliffs CEO: "We See a Huge Opportunity"

Written by Sandy Williams

“If you want to be successful in this business you need to understand the market you serve,” said Cleveland-Cliffs CEO Lourenco Goncalves at the Credit Suisse Basic Materials Conference on Tuesday. Goncalves appears to know what he is doing, having transformed Cleveland-Cliffs from a failing enterprise into a solid business with a unique market position.

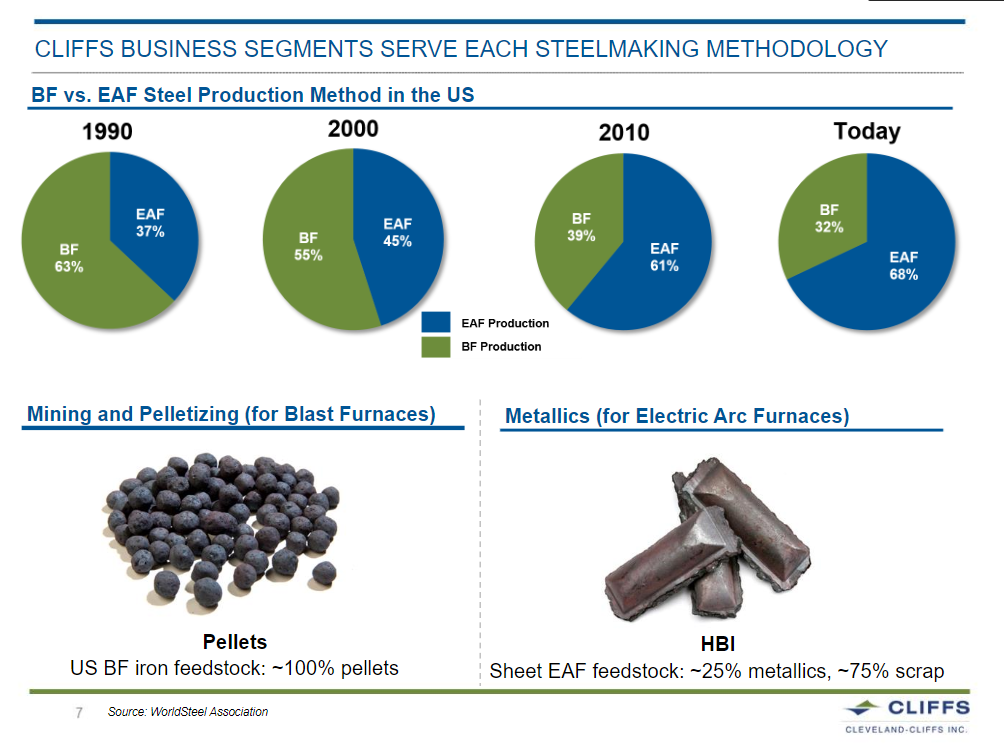

The shift from a steel industry that was two-thirds blast furnace to one that is now two-thirds EAF led to a new strategy for Cliffs. Divesting itself of its coal operations, Cliffs is now 100 percent focused on iron ore and, in particular, supplying quality iron ore pellets to the expanding minimill market.

“EAFs need metallics, that’s EAF by the book; you melt scrap, you get steel, that’s great,” said Goncalves. But as scrap is repeatedly remelted, it becomes contaminated by deleterious elements like copper, making it unfit for use in high-end steel. These elements must be diluted by adding pure iron units. There is not enough prime scrap available in the U.S. to keep up with EAF demand, so the solution is iron ore pellets, said Goncalves.

EAFs in the U.S. import pellets from four main sources—Brazil, Venezuela, the Ukraine and Russia. The pellets are expensive to ship to the Great Lakes region and the quality is unreliable, said Goncalves.

“The fact of the matter is that the four sources of metallics that the EAFs use in the United States are all very close to being shut down,” said Goncalves. To service a growing need in the steel industry, Cliffs is constructing an HBI facility in Toledo, Ohio, that will supply pellets to EAFs in the Midwest and beyond.

“We are going to have simplified logistics, minimal lead times, and in most cases we’re going to do just-in-time with our clients. The EAFs will be exposed to our reliability and the repeatability of the specs that they are not used to,” said Goncalves. Cliffs claims its new plant will be the only HBI facility in the world supplied by a single source of iron ore, in this case its Northshore Mining operation in Minnesota.

The new HBI plant will be Environment, Social and Governance (ESG) rated and will produce 1.9 million metric tons of HBI annually. The stock for the HBI plant will require 2.8 million long tons of iron ore pellets from the 20 million tons that Cliffs produces. Construction is ahead of schedule and initial production is expected in the first half of 2020.

Said Goncalves, “We see a huge opportunity for us among the EAFs, so for three to five years we’re in phenomenal shape.”